Understanding GME Stock: Trends and Market Performance

Introduction: The Significance of GME Stock

The stock of GameStop Corp (GME) has become a focal point of interest for investors and market analysts alike. Initially rising to fame in early 2021 due to a massive short squeeze, GME stock has continued to evoke curiosity and speculation. Understanding its volatility and current market position is crucial for both seasoned investors and newcomers alike.

Current Trends and Recent Developments

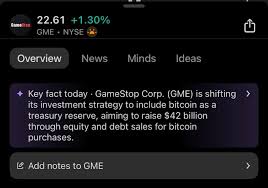

As of October 2023, GME shares have experienced notable fluctuations. The stock recently peaked at approximately $30 per share, which is a significant recovery from its lows earlier in the year. This rise can be credited to GameStop’s strategic pivot towards an online and digital strategy, as well as broader market trends that have seen increased interest in meme stocks once again.

In recent earnings reports, GameStop has demonstrated improved revenues, with the company focusing on its e-commerce platform and digital offerings. Analysts are cautiously optimistic about the company’s pivot towards technology and away from traditional retail sales. Furthermore, the company’s plans to release a blockchain-based marketplace have generated additional interest among tech-savvy investors. These developments suggest that GameStop is attempting to adapt in a changing economic environment.

Market Impact and Investor Sentiment

Market sentiment surrounding GME stock remains a mixed bag. Some retail investors, particularly those who participated in the initial 2021 surge, continue to hold their shares, driven by a commitment to the stock’s narrative and community surrounding it. Meanwhile, traditional investors are more skeptical, exercising caution due to the potential for continued volatility.

Increased trading volumes have again been observed, reminiscent of prior spikes, which indicates that retail investors are returning to the stock. This has sparked discussions about its potential implications for broader market stability, especially considering how GME can influence other stocks and sectors.

Conclusion: What Lies Ahead for GME Stock?

As GME continues to navigate the challenges of a changing retail landscape, its stock remains a crucial point of interest for various investors. Analysts encourage a careful consideration of both the company’s evolving strategy and the broader market indicators. It is essential to keep an eye on upcoming financial reports and market trends, as these will impact both investor sentiment and stock performance moving forward.

For investors, understanding the dynamics at play in GME stock is essential for making informed decisions in these unpredictable times. Stay informed on market conditions, as opportunities may arise as GameStop forges ahead in its new direction.