Understanding GME Stock: Trends and Market Insights

Introduction

The stock of GameStop Corp., commonly referred to as GME stock, has become a significant topic of discussion among investors and analysts alike. With its unprecedented volatility and the rise of retail investors on platforms like Reddit, understanding the current trends of GME stock is crucial for potential investors and market watchers. As of late 2023, the stock is back in the spotlight due to various factors impacting its price and investor sentiment.

Current Market Performance

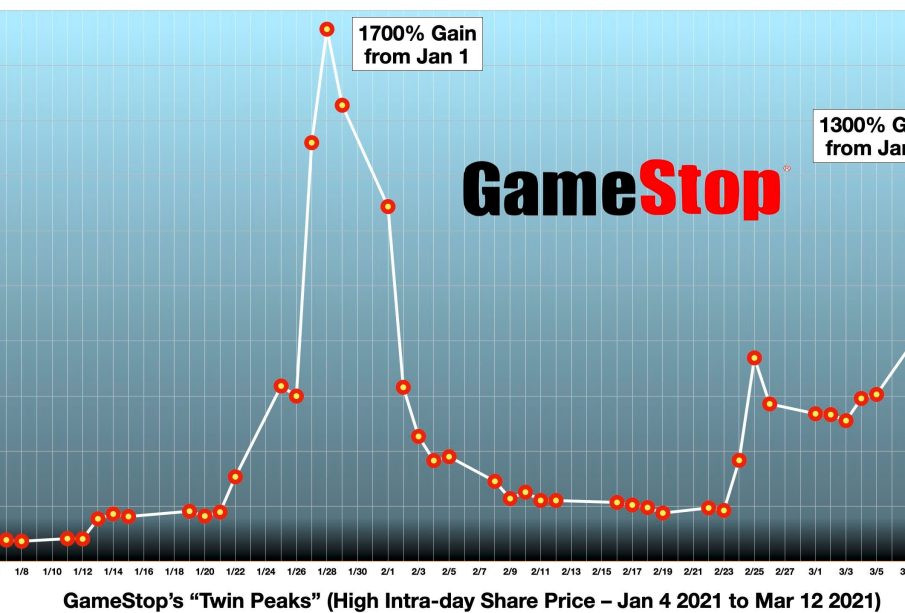

As of mid-October 2023, GME stock is trading around $30 per share, reflecting a substantial shift from its astronomical highs of nearly $500 in January 2021. The stock has witnessed significant fluctuations over the past year, with the price fluctuating between $20 and $45. This volatility is not unusual for GME stock, which has often reacted sharply to news events, market trends, and social media campaigns.

Recent Developments

Several key developments have influenced GME stock in recent months. The company has continued its transition towards a digital-first model, investing heavily in e-commerce and launching initiatives in the gaming and NFT markets. Analysts note that while these efforts could diversify revenue streams, they also bring risks as the company pivots away from its traditional brick-and-mortar model.

Additionally, GME’s recent quarterly earnings report revealed an increase in revenue, though it fell short of analysts’ expectations, leading to mixed reactions among investors. This report was followed by a surge in social media activity, particularly on platforms like Twitter and Reddit, where retail investors expressed varying sentiment about the stock’s future.

Future Forecast and Conclusion

Looking ahead, the future of GME stock remains uncertain but intriguing. As the company continues to adapt to changing consumer habits in gaming and retail, its stock could either bounce back or face further challenges. Analysts suggest keeping an eye on general market trends, interest rates, and investor sentiment on social media, as these will likely have a significant impact on the stock’s trajectory.

In conclusion, GME stock represents both a potential opportunity and risk for investors. The unique nature of its trading patterns, heavily influenced by social media dynamics and retail investor behavior, makes it a stock worthy of careful analysis for anyone looking to navigate the current market landscape.