Understanding GME Stock: Current Trends and Future Insights

The Significance of GME Stock

GME stock, representing GameStop Corp., has become a topic of fascination since early 2021 when it caught the attention of retail investors and social media platforms. The significance of GME stock extends beyond mere price fluctuations, as it represents a shift in retail investing and the power of online communities.

Recent Developments

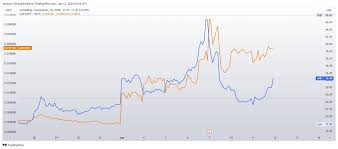

As of October 2023, GME stock has shown a volatile performance. After reaching an all-time high of nearly $483 in January 2021 due to a short squeeze initiated by retail investors, the stock has been on a rollercoaster ride, heavily impacted by trading volume and market sentiment. Recently, the stock price oscillated between $30 and $50, significantly lower than its peak but indicative of ongoing speculation and interest.

Financial Performance and Earnings Reports

The company’s recent earnings report revealed a continued decline in revenue, underscoring the challenges facing brick-and-mortar retailers amid a shifting gaming industry that leans heavily towards digital sales. GameStop has been making efforts to pivot towards e-commerce and explore new revenue streams. These initiatives have led to a cautious optimism among some investors who believe in the company’s potential turnaround.

Investor Sentiment and Community Trends

The sentiment surrounding GME stock remains polarized. Retail investors, many of whom congregate on platforms like Reddit’s WallStreetBets, are still bullish on the stock despite the challenges. A recent survey indicated that about 60% of retail investors continue to hold or buy GME stock, betting on a potential resurgence. Furthermore, analysts have noted that the presence of strong community support could lead to spikes in stock price based on market-driven events rather than fundamentals.

Future Outlook

Looking ahead, analysts suggest that understanding the GME stock’s future will require close attention to broader market trends, investor sentiment shifts, and GameStop’s strategic initiatives. If the company successfully transitions to a more sustainable e-commerce model and builds a valuable online presence, investors might see a more favorable long-term outlook.

Conclusion: What This Means for Investors

For retail investors, GME stock remains a potent symbol of the power of collective action in the stock market. However, with its high volatility, potential investors should approach GME stock with caution and conduct thorough research. As the market evolves, GME stock can serve as a case study in the effects of social media on trading, and the implications of community-driven investing. Understanding this dynamic is crucial for anyone interested in navigating today’s stock market landscape.