Understanding Enbridge Stock: Trends and Future Outlook

Introduction

Enbridge Inc., a major player in the North American energy sector, is widely regarded for its significant pipelines and renewable energy projects. The company’s stock performance is of interest to both investors and analysts, especially in the context of shifting energy demands and climate policies. Recent events and market conditions have made Enbridge stock a focal point for discussions on energy investments.

Current Market Performance

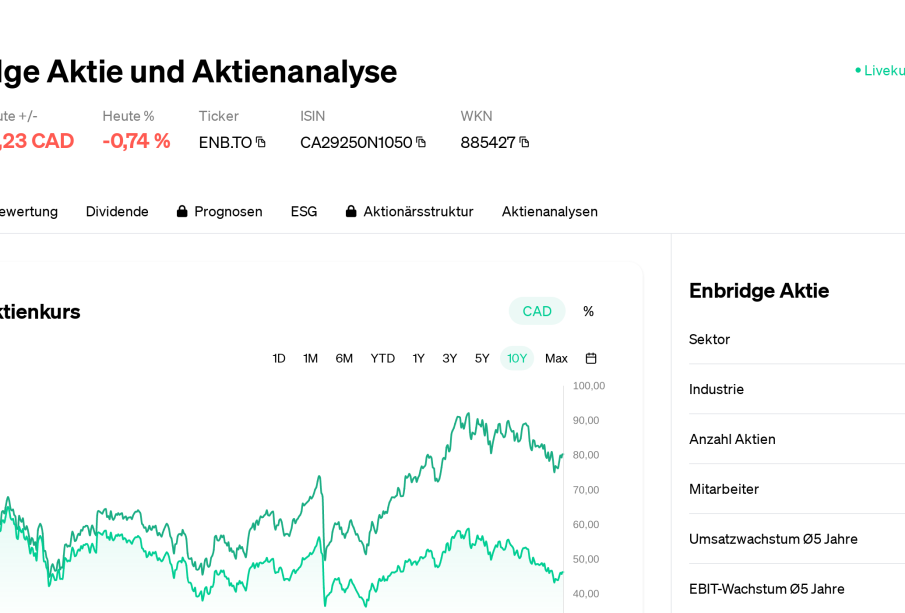

As of October 2023, Enbridge stock is trading at approximately $45 per share, marking a steady rise of 15% over the past year. According to market analysts, various factors have contributed to this increase, including higher oil prices and a renewed focus on infrastructure investments. Enbridge has successfully navigated challenges posed by regulatory hurdles and environmental concerns, which had previously affected its operations.

Recent Events Impacting Stock Valuation

One of the most impactful recent developments was Enbridge’s announcement of a $1.5 billion investment in upgrading its pipeline infrastructure. This is anticipated to enhance safety and efficiency, potentially leading to increased revenue streams. Additionally, Enbridge has been actively pursuing sustainability initiatives, such as expanding its renewable energy portfolio. These moves align with global trends towards cleaner energy solutions, attracting environmentally conscious investors.

Investor Sentiment and Future Outlook

Investor sentiment towards Enbridge appears cautiously optimistic. Analysts forecast that the stock may reach $50 per share in 2024, contingent on steady demand for energy and effective management of operational risks. Dividend enthusiasts are particularly attracted to Enbridge due to its consistent dividend payouts, which currently yield around 6%. Such dividends provide compelling reasons for long-term investment despite market volatility.

Conclusion

In conclusion, Enbridge stock represents a strong investment opportunity amid the evolving landscape of energy infrastructure. With strategic investments and a focus on sustainability, Enbridge is well-positioned for growth. However, potential investors should remain vigilant about market conditions and regulatory changes that could impact the company’s operations. An informed approach will be essential for navigating the complexities of energy investments in the upcoming years.