Understanding Enbridge Stock: Current Trends and Insights

Importance of Enbridge Stock

Enbridge Inc., a key player in North America’s energy infrastructure, has been a focal point for investors, especially in the wake of fluctuating energy prices and changing regulatory landscapes. As one of Canada’s largest energy providers, Enbridge is crucial for understanding not just the energy sector but the broader economic impacts on Canadian markets. With its recent performance and strategic initiatives, the discussion around Enbridge stock is more pertinent than ever.

Recent Trends and Performance

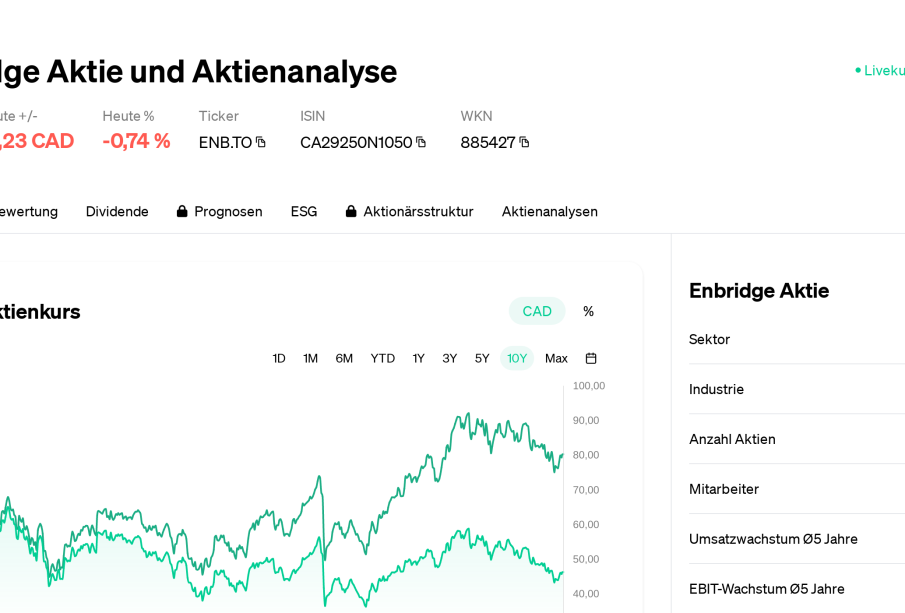

As of October 2023, Enbridge’s stock price has seen a modest recovery following significant downturns earlier in the year due to geopolitical tensions and regulatory challenges. Current market analyses indicate that Enbridge’s stock is trading around CAD 50, reflecting an increase of approximately 15% compared to its lowest point in early 2023.

The company recently reported its Q3 earnings, showing a revenue increase of 10% year-over-year, attributed mainly to higher demand in its liquids and gas transportation segments. Furthermore, Enbridge disclosed plans to expand its renewable energy portfolio, with investments in wind and solar projects that could enhance its sustainability profile and attract environmentally conscious investors.

Investment Considerations

Investing in Enbridge stock is generally viewed as a stable option due to its history of regular dividend payouts, which currently yields about 6.5%. However, potential investors should consider the inherent risks associated with the energy sector, including volatility in oil and gas prices and potential changes in government policy concerning carbon emissions.

Conclusion: Looking Ahead

The future for Enbridge stock appears cautiously optimistic as the company adapts to changing market dynamics and societal demand for cleaner energy. Analysts recommend monitoring ongoing developments in both the energy sector and regulatory frameworks. Investors should weigh the potential for growth against the risks characteristic of the energy sector. Keeping abreast of global energy trends will be pivotal for anyone considering an investment in Enbridge.