Understanding CRWD Stock: Insights and Market Movements

Introduction

CRWD stock, representing CrowdStrike Holdings, Inc., has become increasingly important in the tech and cybersecurity sectors. As organizations continue to prioritize the protection of their digital assets, the demand for CrowdStrike’s innovative cybersecurity solutions has surged. This article aims to provide a comprehensive overview of CRWD stock, analyzing its performance amidst current market dynamics and the potential future implications for investors.

Current Market Performance

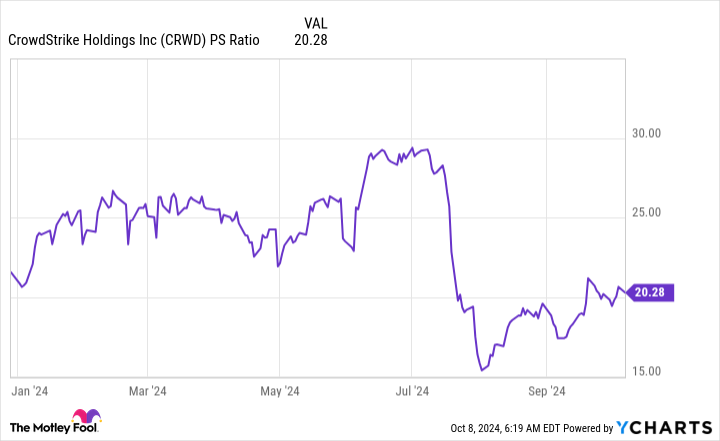

As of October 2023, CRWD stock has experienced significant fluctuations but continues to show resilience. The stock price recently ranged around $180, having seen a growth trajectory since the beginning of the year. Analysts attribute this positive momentum to several factors, including the company’s robust quarterly earnings, expansion of customer base, and the overarching trend of increasing cyber threats which drive demand for their services.

In its latest earnings report, CrowdStrike reported revenue of $641 million, marking a 54% year-on-year increase. This impressive growth was bolstered by an increase in subscription customers, which reached approximately 21,000, highlighting the effectiveness of its cloud-native platform. Additionally, the company’s forecast for the next quarter indicates continued revenue growth, predicting between $660 million and $670 million for Q4 2023.

Industry Trends Affecting CRWD Stock

The cybersecurity landscape is evolving rapidly, with increasing cyber threats prompting organizations to adopt advanced security solutions. The global cybersecurity market is projected to reach $345.4 billion by 2026, representing a compounded annual growth rate (CAGR) of 10.9%. As a leader in endpoint security, CrowdStrike is well-positioned to capitalize on this expansion. Factors such as remote work, cloud adoption, and regulatory compliance are driving organizations to invest in robust cybersecurity frameworks, thereby benefiting CRWD stock in the long term.

Conclusion

In summary, CRWD stock represents a strong opportunity for investors looking to tap into the growing cybersecurity market. With its recent performance, expansion strategies, and favorable industry trends, CrowdStrike appears well-equipped for future growth. As the importance of cybersecurity continues to escalate, investors may want to closely monitor CRWD stock as part of a well-diversified portfolio. The company’s resilience in the face of market fluctuations underscores its potential for sustained success in the coming years.