Understanding CRM Stock: Trends and Investor Insights

Introduction to CRM Stock

CRM stock, representing Salesforce.com Inc., has garnered significant attention in the financial markets due to its pivotal role in cloud computing and customer relationship management services. As businesses increasingly rely on digital tools to enhance customer interactions, the relevance of CRM solutions continues to grow. Understanding the dynamics of CRM stock is vital for investors looking to navigate the complexities of the tech industry.

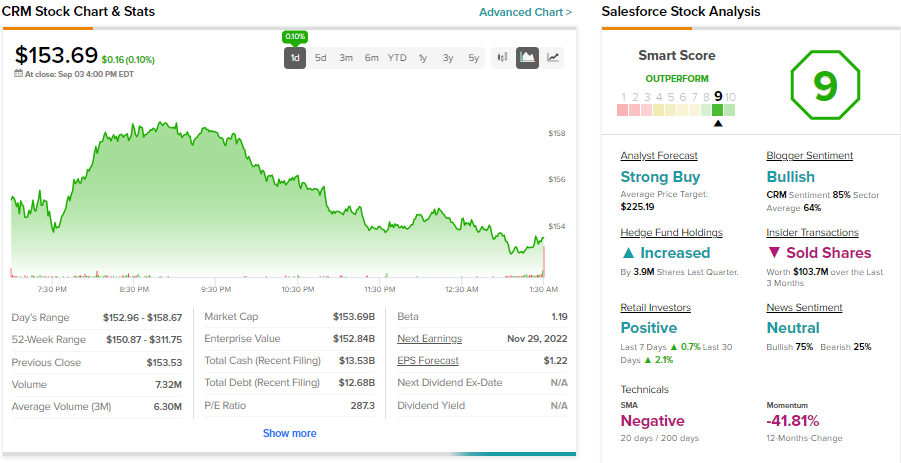

Recent Performance of CRM Stock

As of October 2023, CRM stock has seen fluctuations that reflect broader economic trends. The stock price, which was approximately $220 in early September, experienced a notable dip to around $200 by mid-October, primarily due to concerns over inflation impacts on technology spending and a cautious outlook released during Salesforce’s recent earnings call. However, analysts indicate that the long-term prospects for CRM stock remain strong, with projected revenue growth fueled by expanding enterprise software needs.

Market Analysis

Recent quarterly reports highlight key growth areas for Salesforce, particularly in the areas of artificial intelligence and customer data platforms. With the rising demand for integrated solutions that provide seamless experiences across multiple touchpoints, Salesforce’s strategy appears well-positioned. Analysts from reputable firms like Morgan Stanley and Goldman Sachs have issued favorable ratings, underscoring the sound fundamentals of the company despite temporary market volatility.

Investor Sentiment and Forecast

The current sentiment among investors appears cautiously optimistic. With major competitors like Microsoft and SAP enhancing their offerings, Salesforce is focusing on innovation, which may bolster its competitive edge. Predictions for the CRM stock over the next few quarters suggest a potential rebound, especially if economic indicators stabilize. Moreover, many investors are encouraged by Salesforce’s commitment to expanding its product suite and maintaining robust customer relationships.

Conclusion

In summary, CRM stock continues to be a significant player within the tech sector, driven by the global demand for effective customer management solutions. While short-term fluctuations can evoke concern, the long-term outlook remains positive based on Salesforce’s strategic initiatives. For investors, it is crucial to analyze market trends, earnings reports, and competitive positioning as they make decisions regarding CRM stock. As the digital landscape evolves, Salesforce’s ability to innovate and adapt will determine its trajectory and impact on investor portfolios.