Understanding CPP Payments: Recent Changes and Impact

Introduction

Canada Pension Plan (CPP) payments are a crucial component of financial security for millions of Canadians in retirement. As life expectancy increases, the relevance of reliable pension payments cannot be overstated. Recently, the CPP has undergone significant adjustments to ensure continued support for retirees and those unable to work. Understanding these changes and their implications is essential for Canadians planning for their financial future.

Recent Changes in CPP Payments

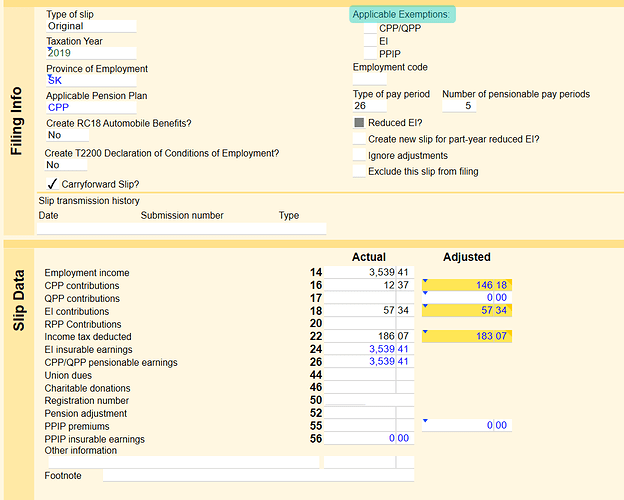

As of January 2024, the Government of Canada has announced an increase in the standard CPP benefit. The increase is part of a gradual enhancement to the CPP that began in 2019, designed to provide more financial support to individuals who have contributed to the plan throughout their working life. This enhancement is expected to raise the maximum monthly benefit to about $1,200, a notable increase from approximately $1,066 in 2023.

In addition, the automatic indexation of benefits aligned with inflation will also contribute to the increase in payments. This is a critical step as inflation affects the purchasing power of retirees. The increase in CPP Payments ensures that beneficiaries can maintain their standard of living as the cost of goods and services rises.

Impact on Canadians

The enhancement of CPP payments is projected to benefit over 14 million Canadian residents, particularly those nearing retirement age. Many Canadians rely heavily on these payments, and the increase provides valuable relief in light of rising living costs. According to Statistics Canada, a significant percentage of retirees depend on CPP as a primary income source, making these adjustments vital for their economic well-being.

These changes also coincide with broader governmental efforts to enhance financial literacy among Canadians, especially youth and new workers who are just beginning their careers. Educating younger generations about the importance of early contributions to CPP can further strengthen the fund’s sustainability.

Conclusion

In conclusion, the recent adjustments to CPP payments highlight the Canadian government’s commitment to supporting its aging population. The increase in benefits is a necessary response to evolving economic conditions and the requirements of current and future retirees. As more Canadians prepare for a retirement that may span decades, understanding these changes is critical. With thoughtful planning and awareness, Canadians can navigate their retirement years with greater confidence, knowing that enhancements to CPP are designed to support them now and in the future.