Understanding CPP Payments and Their Impact on Canadians

Introduction to CPP Payments

The Canada Pension Plan (CPP) is a crucial pillar of retirement income for Canadians, ensuring financial stability for millions of retirees. As the country’s population ages, understanding CPP payments becomes increasingly relevant for current and future pensioners. With the latest updates and changes in the CPP, it is essential to inform Canadians about their benefits and how to maximize them.

What Are CPP Payments?

CPP payments are monthly benefits provided to individuals who have contributed to the Canada Pension Plan during their working years. There are several types of payments including retirement benefits, disability benefits, and survivors’ benefits. For 2023, the average monthly amount for new beneficiaries is around $1,200, with the maximum reaching approximately $1,500, depending on the contribution history.

How Are CPP Payments Calculated?

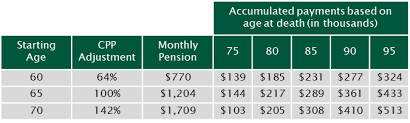

The amount individuals receive from CPP is based on the contributions made during their working life. The more you contribute, the higher your benefits upon retirement. Contributions are mandatory for employees and self-employed people, who pay a percentage of their earnings into the CPP. Moreover, payments can begin as early as age 60, but starting payments before age 65 can reduce the monthly amount.

Recent Changes in CPP

In recent years, the Canadian government has made efforts to enhance the CPP. Notably, a phased increase of contributions began in 2019, which aims to increase the benefits paid out. By 2025, Canadians can expect their maximum benefits to rise significantly, which is designed to provide better support during retirement.

The Importance of Planning for CPP Payments

As part of retirement planning, individuals must take CPP payments into account to ensure a secure financial future. Experts recommend maintaining an updated estimate of expected CPP benefits through the Canada Revenue Agency’s online tools or consulting with a financial advisor.

Conclusion

CPP payments play a vital role in the financial well-being of Canadian retirees. With changes on the horizon poised to enhance these benefits, it is crucial for Canadians to stay informed and make educated decisions about their retirement planning. As the government continues to work toward optimizing the CPP, understanding these payments will become even more significant for future generations.