Understanding CPP Payment Dates: What Canadians Need to Know

Introduction

The Canada Pension Plan (CPP) is a crucial component of Canada’s social security system, providing income support to retired Canadians, as well as those with disabilities and survivors of deceased contributors. Understanding CPP payment dates is essential for beneficiaries to manage their finances effectively. Knowing when to expect payments can alleviate financial stress and help beneficiaries plan for their monthly expenses.

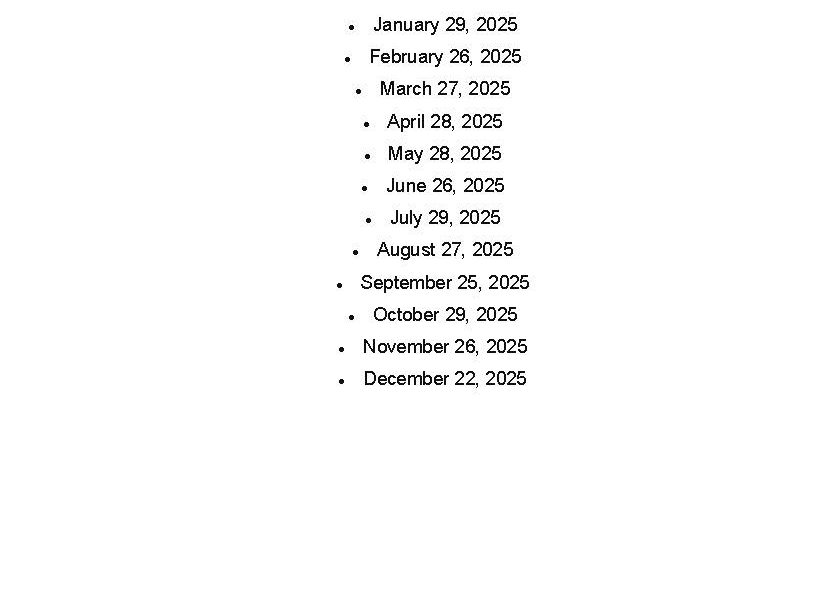

CPP Payment Schedule

CPP payments are typically disbursed monthly, with payments arriving on the third last business day of each month. For example, in October 2023, payments will be issued on the 27th. The payment schedule is established by the Canada Revenue Agency (CRA) and is consistent each month, making it easier for beneficiaries to anticipate when they will receive funds.

Eligibility and Payment Amounts

Eligibility for CPP payments begins at age 60, but individuals can choose to begin receiving benefits as early as that age or as late as age 70. The amount received depends on contributions made during the contributor’s working life, affecting how much beneficiaries receive based on how long they contributed and when they choose to start receiving payments. In 2023, the average monthly amount for new beneficiaries at age 65 was approximately $1,200, though this can vary widely based on individual circumstances.

Impact on Personal Finances

For many Canadians, CPP is a vital source of income in retirement, often serving as a supplement to personal savings. It’s crucial for older adults to understand the implications of their decision regarding when to start receiving CPP benefits. Opting for early payments can mean a reduction in monthly payouts, while delaying could result in higher payments later on.

Conclusion

Understanding CPP payment dates is key for Canadians relying on this pension as part of their retirement strategy. With payments consistent and predictable, beneficiaries can plan their finances with more assurance. As millions approach retirement age, staying informed about these dates and the implications of starting to receive CPP benefits early or late will be increasingly important for effective financial planning.