Understanding Coinbase Stock and Its Market Significance

Introduction

Coinbase Global, Inc. has been a significant player in the cryptocurrency exchange market since its inception. As one of the largest and most reputable platforms for trading Bitcoin, Ethereum, and other digital assets, Coinbase went public in April 2021 under the ticker symbol ‘COIN’. The performance of Coinbase stock is vital as it reflects broader trends in the cryptocurrency market and economic sentiments towards digital currencies.

Recent Developments in Coinbase Stock

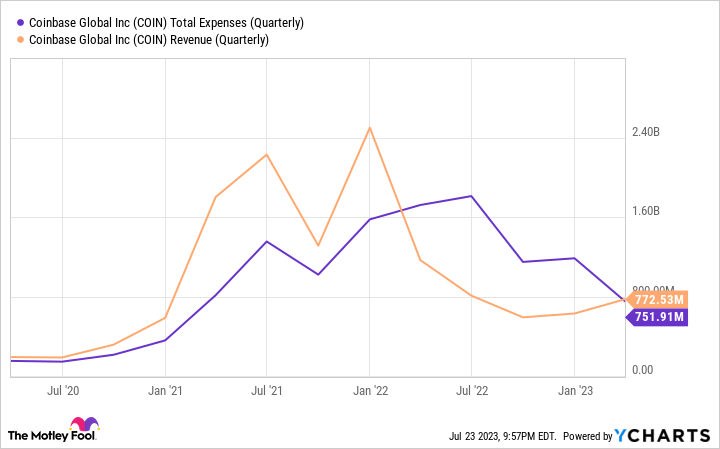

As of late 2023, Coinbase stock has experienced various fluctuations reflecting changes in market dynamics, regulatory news, and investor sentiment towards cryptocurrencies. The recent announcement by the U.S. Securities and Exchange Commission (SEC) regarding potential regulatory measures targeting crypto exchanges has created increased volatility in the market. The stock saw a significant drop of approximately 15% in response to the news, highlighting how external factors can heavily influence its valuation.

Additionally, Coinbase has also been responding to increased competition in the space, with new players entering the market, and has been innovating its services to retain its customer base. The company has expanded its offerings, including educational resources and a broader suite of Web3 products, which is a strategic move aimed at capturing more users amid increasing competition. Analysts suggest that this diversification could stabilize the stock in the long run, despite inherent market volatility.

Investment Outlook and Volatility

Market analysts are closely monitoring the stock as it navigates these challenges. Despite the recent downturn, some experts remain optimistic about Coinbase’s long-term growth, pointing to the increasing adoption of cryptocurrencies as part of investment portfolios. The trend shows that institutional investment in digital assets is likely to grow, potentially benefiting established platforms like Coinbase. However, considerable risks remain, given the unpredictability of crypto markets and regulatory landscapes.

Conclusion

As cryptocurrency continues to gain notoriety, Coinbase stock remains a pivotal point of interest for investors looking to engage with the market. The fluctuations it experiences are not merely reflective of the company’s performance but are also indicative of broader market sentiments and regulatory environments. Investors should approach with caution, given the volatility observed, but recognize that Coinbase’s proactive strategies may assist in navigating these turbulent waters. The future of Coinbase stock will largely depend on its capability to adapt to market demands and regulatory challenges while capitalizing on the increasing integration of cryptocurrency into mainstream finance.