Understanding Capital Gains Tax in Canada: 2023 Updates

Introduction

Capital gains tax is a critical aspect of the Canadian tax system, impacting numerous taxpayers as they consider the sale of various assets, including real estate, stocks, and investments. In 2023, with fluctuating markets and evolving economic conditions, understanding the implications of capital gains tax becomes essential for anyone involved in asset transactions. This article illuminates recent updates, implications for individuals and businesses, and essential information that every Canadian taxpayer should know.

What is Capital Gains Tax?

Capital gains tax is a tax levied on the profit made from the sale of an asset. In Canada, only 50% of the capital gain is taxable, meaning that if an individual sells an asset for more than its purchase price, they will only be taxed on half of the profit. For example, if you bought a property for $200,000 and sold it for $300,000, your capital gain would be $100,000, but only $50,000 would be subject to tax.

Recent Developments in 2023

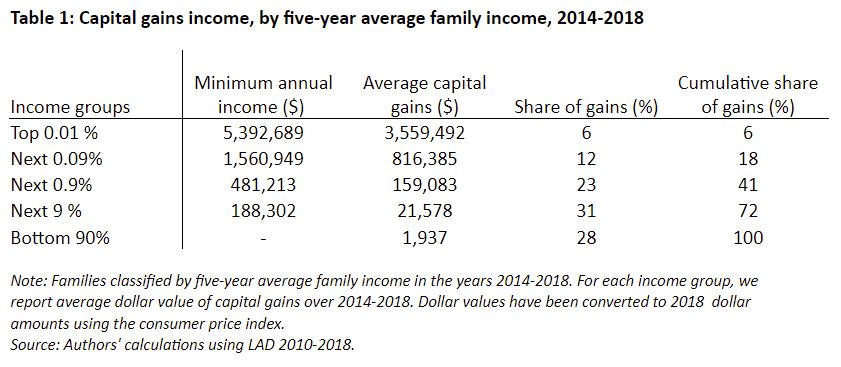

In 2023, there have been discussions regarding the potential adjustments to capital gains tax as part of broader tax reform discussions among policymakers in Canada. The government has indicated that it aims to close loopholes and ensure that high-income earners contribute fairly to the tax system. The consultations include evaluating whether reigning in the preferential treatment of capital gains could intensify, particularly as the government seeks to balance budgets and address income inequality.

Who is Affected?

Capital gains tax affects a wide demographic of Canadians, particularly those involved in investment activities, real estate transactions, or businesses with significant asset holdings. For individual taxpayers, understanding capital gains tax’s mechanics is vital when planning for the sale of property or stock holdings. In addition, businesses must consider the impact of capital gains taxes on their profit margins when restructuring or divesting assets.

Strategies for Managing Capital Gains Tax

Taxpayers have several strategies to manage their capital gains tax effectively. These include:

- Tax-loss harvesting: Offset capital gains with losses from other investments to reduce taxable income.

- Holding period: Consider holding onto investments for longer periods to benefit from appreciation without realization of the gain.

- Utilizing Tax-Free Savings Accounts (TFSAs): Investments within a TFSA grow tax-free, meaning that gains will not be subject to capital gains tax when withdrawn.

Conclusion

As discussions surrounding potential reforms to capital gains tax in Canada evolve in 2023, it is crucial for taxpayers to remain informed about their responsibilities and options. With the possibility of increased scrutiny and changes to tax structures, Canadians should engage in proactive planning and maintain awareness of the current tax landscape. Consulting with financial advisors or tax professionals is essential for making informed decisions about asset sales and navigating the complexities of capital gains tax effectively.