Understanding Canadian Dental Plans: What You Need to Know

Importance of Dental Health

Oral health is an integral part of overall health and wellness. Access to dental care can significantly impact a person’s quality of life, and preventative dental services have been shown to reduce the risk of chronic diseases. With this in mind, having a reliable dental plan is crucial.

Current Landscape of Canadian Dental Plans

In Canada, dental services are not part of the universal healthcare system. As a result, many Canadians rely on private dental insurance plans to cover basic and major dental procedures. According to a report from the Canadian Dental Association, about 63% of Canadians have some form of dental insurance. This statistic underscores the importance of understanding the various dental plan options available.

Types of Canadian Dental Plans

There are typically three main types of dental plans available in Canada:

- Employer-sponsored plans: Many employers offer dental insurance as part of their benefits package. This often provides the most cost-effective coverage for employees.

- Individual dental plans: For those self-employed or whose employers do not offer dental insurance, individual plans are widely available. These can vary significantly in coverage, cost, and eligibility.

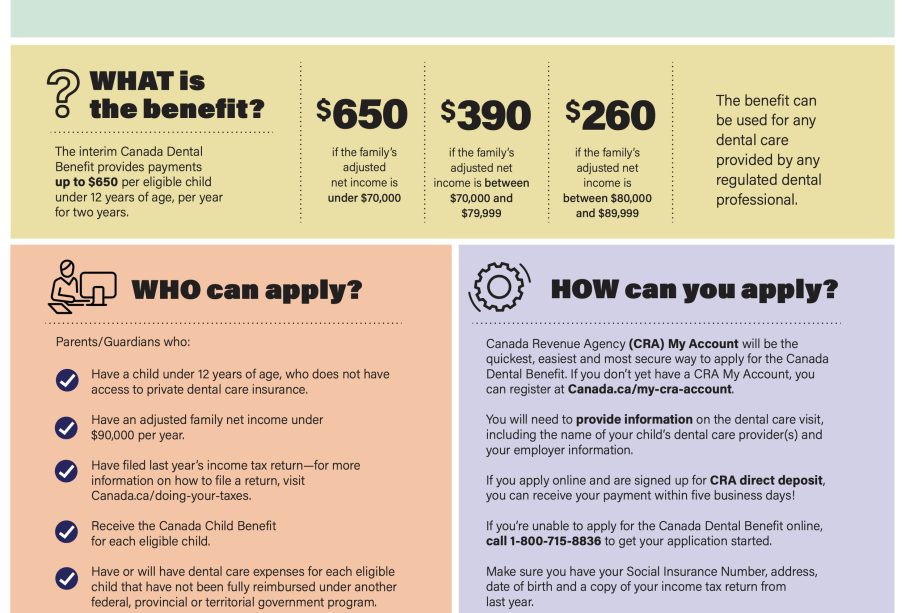

- Government assistance programs: Certain populations, including low-income families and seniors, may qualify for government-funded dental services in their provinces or territories, though coverage can vary.

Key Features and Considerations

When evaluating dental plans, individuals should consider factors such as:

- Coverage Limits: Many plans have annual maximum amounts. Understanding how much coverage is provided annually is essential for planning your dental expenses.

- Types of Procedures Covered: Not all plans cover the same procedures; some may include routine check-ups, while others may not cover orthodontic work.

- Waiting Periods: Some plans may impose waiting periods for specific treatments, so it’s beneficial to review these conditions beforehand.

- Out-of-pocket Costs: Always check for copayments, deductibles, and coinsurance that may apply to various treatments.

Conclusion

With the diverse range of dental plans available in Canada, it is essential for individuals to thoroughly research and understand their options to choose a plan that meets their personal and family needs. As oral health continues to be recognized for its connection to overall health, benefiting from a comprehensive dental plan can lead to improved health outcomes and financial peace of mind for Canadian families.