Understanding Canada’s Trade Deficit: Causes and Consequences

Introduction

The trade deficit has emerged as a critical aspect of Canada’s economic landscape, grabbing attention among policymakers, economists, and citizens alike. In simple terms, a trade deficit occurs when a country’s imports exceed its exports, indicating potential challenges to its economic health and international competitiveness. This growing trend in Canada warrants examination as it can impact job creation, currency value, and overall economic growth.

Current Trade Deficit Overview

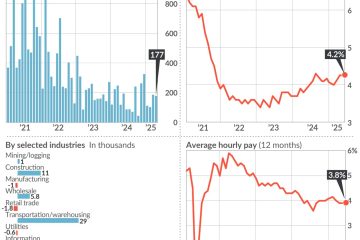

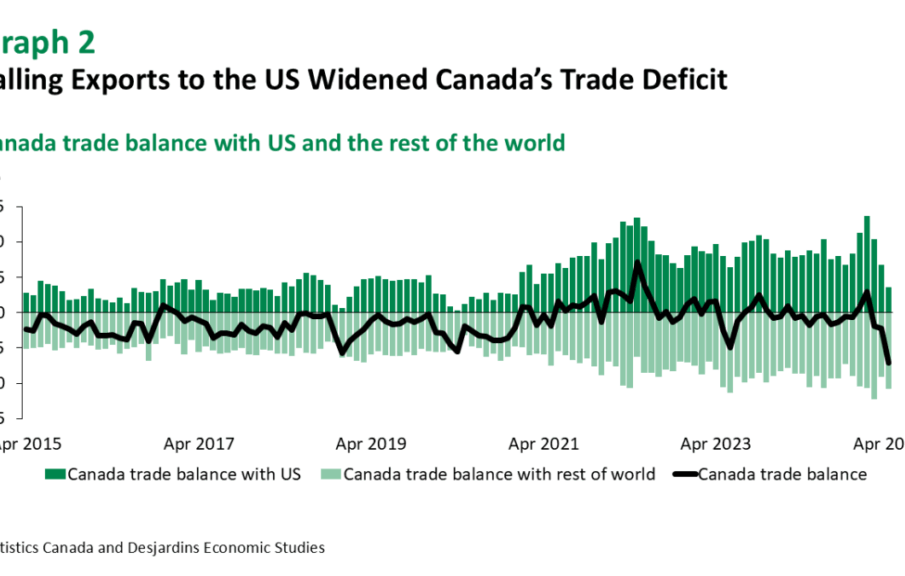

As of August 2023, Canada’s trade balance reported a deficit of $3.5 billion, with total imports reaching $58 billion while exports were at $54.5 billion. This indicates a widening gap compared to previous months, where trade figures showcased slight surpluses or lower deficits. The increase in the trade deficit is largely attributed to the surging demand for consumer goods and essential materials as the country rebounds from the pandemic, coupled with a decline in export volumes, particularly in the energy sector.

Contributing Factors

Several factors contribute to the ongoing trade deficit in Canada:

- Market Dependence: Canada’s economy heavily relies on exports of natural resources, like oil and minerals. The fluctuating prices of these commodities can significantly affect the trade balance.

- Global Supply Chain Issues: Disruptions caused by the COVID-19 pandemic and geopolitical tensions have impacted the availability of goods globally, driving up import costs.

- Strong Consumer Demand: The pent-up consumer demand seen post-pandemic led many Canadians to import higher volumes of goods, particularly in technology and retail sectors.

- Currency Valuation: The Canadian dollar’s strength can make exports more expensive and imports cheaper, further contributing to the deficit.

Implications of the Trade Deficit

The trade deficit holds several implications for Canada’s economy. A persistent deficit may lead to increased borrowing and debt, which can impact government spending capabilities. Economists warn that prolonged trade deficits can weaken domestic industries, making Canada more susceptible to external market fluctuations. Moreover, currency devaluation may occur, raising the costs of imported goods, leading to inflationary pressures for consumers.

Conclusion

In conclusion, Canada’s growing trade deficit is a complex issue rooted in various economic factors. As the government analyzes this trend, forecasts suggest that continued emphasis on diversifying export markets and bolstering domestic manufacturing could mitigate the adverse effects of the deficit. For Canadian citizens, understanding these dynamics is crucial as they can have direct implications on employment rates and the cost of living. Monitoring the situation will remain important for all stakeholders as the global economy continues to evolve.