Understanding Canada’s Inflation Trends in 2023

The Importance of Monitoring Inflation

Inflation is a critical economic indicator that affects purchasing power, investment, and consumption in Canada. As inflation rates fluctuate, they have profound implications for households and businesses alike. The Bank of Canada’s efforts to manage inflation play a pivotal role in shaping the overall economic landscape.

Current Inflation Rates

As of October 2023, Canada is experiencing a significant inflation rate of approximately 4.1%, according to the latest data from Statistics Canada. This marks a decrease from the peak rates seen in previous months, shedding light on the ongoing recovery of the economy following the challenges posed by the COVID-19 pandemic.

Contributing Factors

Several factors have contributed to the recent inflation trends. Firstly, supply chain disruptions caused by the pandemic have led to increased costs for goods and services. Secondly, rising energy prices, particularly due to geopolitical tensions and changes in global supply chains, have exacerbated the cost of living for Canadians. Lastly, wage growth has also contributed to inflation as businesses strive to attract and retain employees in a tightening job market.

Impact on Canadians

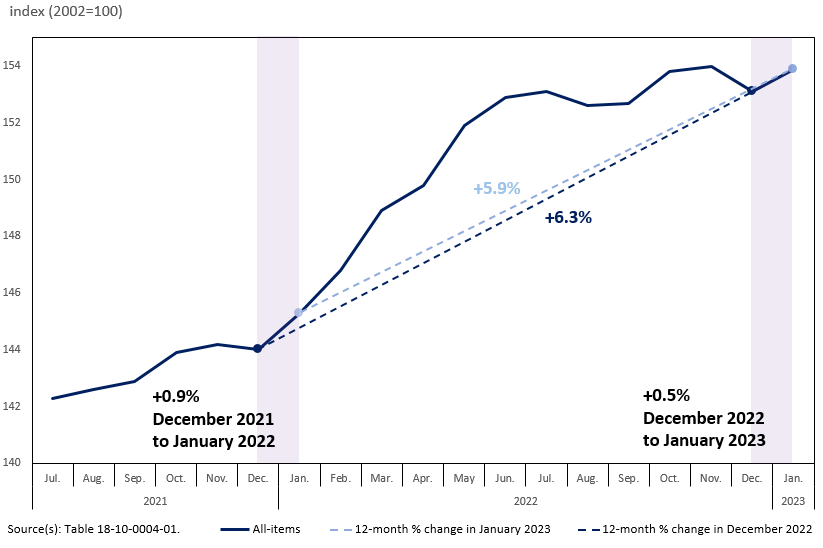

The rising inflation rate has directly impacted the cost of living for many Canadians, creating challenges for households as grocery prices, housing costs, and transportation expenses continue to climb. Notably, the Consumer Price Index (CPI) data reflects substantial increases in essential goods, which has raised concerns regarding affordability for middle and low-income families.

Government and Bank of Canada Response

In response to rising inflation, the Bank of Canada has indicated potential interest rate adjustments to help stabilize the economy. Analysts predict that the central bank may continue to monitor the situation closely, utilizing monetary policy tools to curb inflationary pressures while fostering economic growth. Moreover, the government has initiated various programs aimed at alleviating the pressures faced by vulnerable populations, including targeted financial aid and subsidies.

Looking Ahead

The outlook for Canada’s inflation in the coming months remains uncertain. Economists suggest that while there may be short-term fluctuations, overall inflation is expected to stabilize in response to government actions and market adjustments. It is crucial for Canadians to stay informed about these economic trends, as changes in inflation rates will undoubtedly influence purchasing decisions and economic planning.

Conclusion

Inflation remains a pressing issue in Canada, with ongoing developments affecting not only economic policy but everyday life for citizens. As we move toward the end of 2023, keeping a close watch on inflationary trends will be vital for Canadians as they navigate their financial futures.