Understanding Canada Pension Plan Payments

Introduction

The Canada Pension Plan (CPP) is a vital component of the social welfare system in Canada, providing financial support to millions of Canadians during retirement, disability, or the death of a contributor. With the aging population and an increasing number of beneficiaries, it is crucial to understand how CPP payments work, their relevance in today’s economy, and the factors that influence them.

What are Canada Pension Plan Payments?

Canada Pension Plan payments are monthly benefits provided to eligible Canadians who have contributed to the plan throughout their working lives. The contributions, primarily taken from employees’ salaries and matched by employers, fund these payments. In 2023, the maximum monthly amount for new beneficiaries starting to receive their pension at age 65 is $1,306.57; however, the average monthly payment as of July 2023 is around $1,066.35.

Recent Developments in CPP Payments

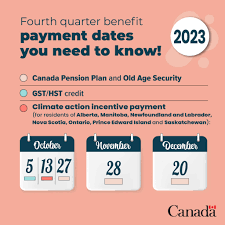

In response to rising living costs and inflation, the Canada Pension Plan Investment Board (CPPIB), which manages the plan’s assets, has made several adjustments to ensure the sustainability and growth of the fund. In 2022, CPP took a conservative investment strategy amidst volatile markets, which was reflected in a 5.7% increase in payments at the start of 2023. Furthermore, increases in payment amounts are often tied to changes in the Consumer Price Index (CPI), with adjustments made each January to help beneficiaries maintain their purchasing power.

Benefits of the Canada Pension Plan

The primary benefits of the CPP lie in its contribution-based structure, which ensures that careful planning can yield substantial payouts for residents. Many Canadians rely on these payments to cover living expenses during retirement. Moreover, the plan provides additional benefits for those who become disabled or for the surviving families of deceased contributors. This safety net is essential in a time when many private pension plans are becoming increasingly rare and less lucrative.

Conclusion

The significance of Canada Pension Plan payments cannot be understated, as they play a critical role in the financial stability of retirees. As Canada continues to grapple with an aging population, policymakers and financial planners alike must consider the sustainability of the CPP system. Future amendments to the plan’s structure are likely to focus on enhancing the benefits while maintaining fiscal responsibility. For many Canadians, understanding these payments and planning ahead is vital for a secure financial future.