Understanding BTC USD: Trends, Analysis, and Future Outlook

Introduction to BTC USD

The BTC USD pair represents the exchange rate between Bitcoin (BTC), the leading cryptocurrency, and the US Dollar (USD), the world’s primary fiat currency. Understanding this pair is critical for investors and traders, as it reflects broader market trends, investor sentiment, and regulatory developments. The current landscape of cryptocurrency trading and investment makes the BTC USD exchange rate particularly relevant, especially in light of recent fluctuations and market behavior.

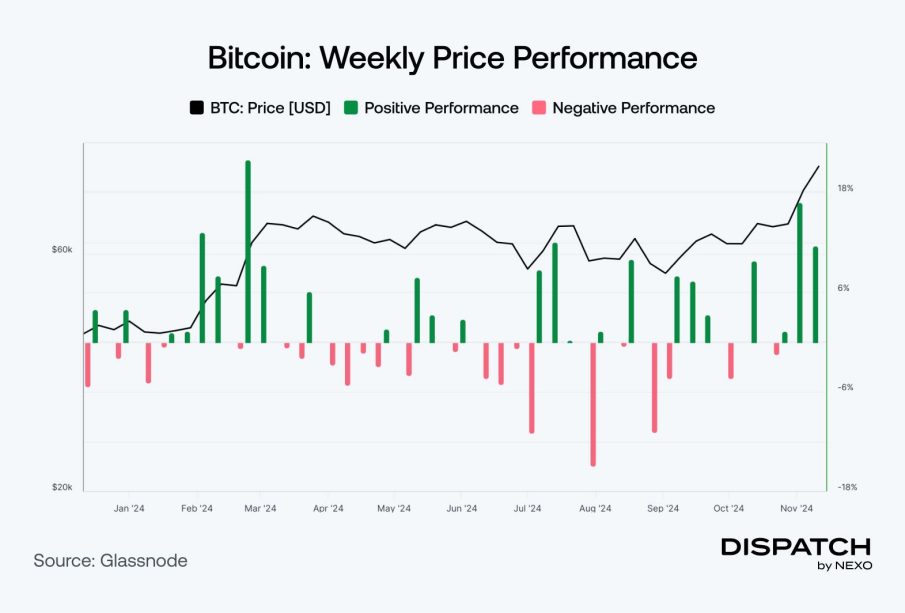

Current Trends in BTC USD

As of October 2023, the BTC USD price has experienced significant volatility. After a dramatic surge in mid-2023, where Bitcoin’s price reached new heights nearing $40,000, recent market corrections have brought it down to around $25,000. Analysts attribute this fluctuation to a mix of macroeconomic factors, such as changes in interest rates, inflation concerns, and ongoing regulatory discussions surrounding cryptocurrencies. A recent report indicates that Bitcoin has gained about 30% in value since the beginning of the year, though the sharp decline has prompted various market reactions.

Factors Influencing BTC USD

Several factors influence the BTC USD exchange rate:

- Market Sentiment: Investor sentiment is often shaped by news regarding regulatory decisions, technological advancements, and macroeconomic conditions, leading to rapid shifts in the price.

- Adoption Rates: Increased adoption of Bitcoin by businesses and retail investors can drive demand, bolstering its price against USD.

- Institutional Investment: The entry of institutional investors into the cryptocurrency market introduces large capital inflows, significantly affecting the BTC USD price.

Recent Developments

In recent months, some major financial institutions have begun to engage with Bitcoin and other cryptocurrencies, offering trading options and investment opportunities. Additionally, regulatory bodies in the United States have started to clarify their positions on cryptocurrency exchanges and stablecoins, contributing to market stability. However, some analysts warn that looming regulatory hurdles, particularly concerning taxation and compliance, could impact future price movements.

Conclusion and Forecast

The BTC USD exchange rate is subject to intense scrutiny and fluctuates due to a complex interplay of market forces and regulatory environments. With Bitcoin poised as a significant asset class, understanding its valuation against the US Dollar remains essential for stakeholders. While current conditions suggest further volatility may persist, some analysts remain optimistic about a potential recovery, forecasting that Bitcoin could challenge previous highs in the coming months depending on market adoption and regulatory clarity. Overall, both investors and traders should remain vigilant and informed about the ongoing developments in the cryptocurrency landscape.