Understanding BTC USD: Current Trends and Market Analysis

Introduction

The relationship between Bitcoin (BTC) and the US dollar (USD) has become a focal point for investors and financial analysts alike. As a leading cryptocurrency, Bitcoin’s value against the dollar is closely monitored, influencing trading strategies and investment decisions. Understanding BTC USD is crucial for anyone involved in the cryptocurrency ecosystem, as it reflects the broader market sentiments and economic trends.

Current Trends in BTC USD

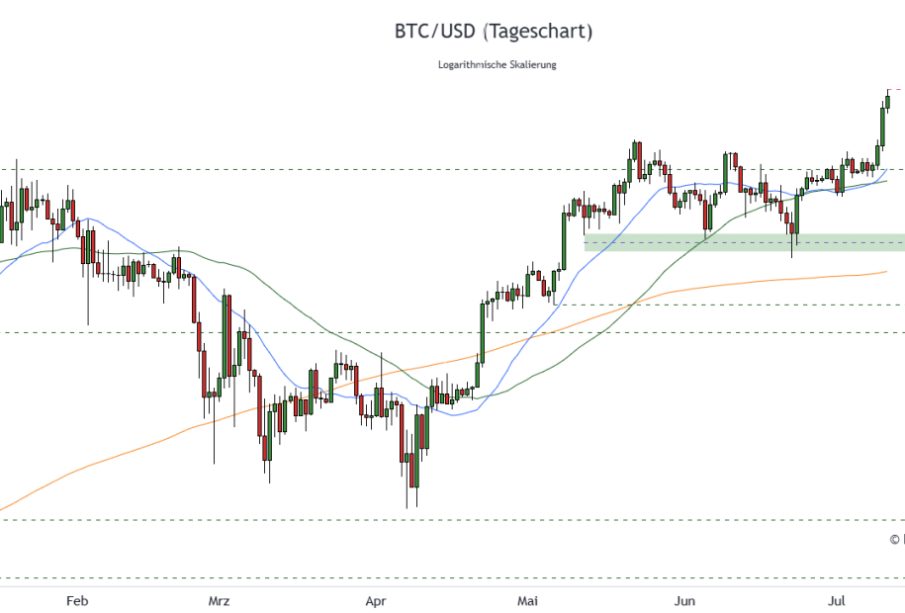

As of October 2023, BTC has shown significant volatility against the USD, with prices fluctuating between $26,000 to $32,000 in recent weeks. This volatility is largely attributed to macroeconomic factors including inflation concerns, interest rate changes by the Federal Reserve, and global economic conditions. Analysts note that the upcoming Bitcoin halving, expected in 2024, is also shaping market predictions about future price movements.

In recent weeks, Bitcoin has faced downward pressure as macroeconomic conditions shift. Data from CoinMarketCap reveals a drop in trading volume, signaling a cautious approach from investors. Cryptocurrency exchanges have reported increased activity around support and resistance levels, indicating traders are closely watching for potential breakouts.

Factors Influencing BTC USD

Several factors contribute to the ongoing fluctuations of BTC against the USD:

- Regulatory Environment: Regulatory news, particularly from major economies like the United States and Europe, can greatly influence market conditions. Any announcements regarding cryptocurrency regulations can lead to immediate market responses.

- Institutional Adoption: The involvement of institutional investors has helped to legitimize Bitcoin as a store of value, impacting its price in conjunction with traditional assets.

- Technological Developments: Upgrades to the Bitcoin network, including improvements in scalability and security, can affect investor confidence and drive price changes.

Conclusion

The BTC USD exchange rate serves as a barometer for both the cryptocurrency market and broader economic indicators. As Bitcoin continues to attract attention from both retail and institutional investors, understanding its price movements against the USD becomes increasingly important. Looking forward, analysts predict that as regulatory frameworks become clearer and more institutional money enters the market, Bitcoin could experience significant upward pressure. Stakeholders are advised to stay informed about economic trends and technological developments as they navigate this evolving landscape.