Understanding Bitcoin Price USD: Current Trends and Impacts

Introduction

The price of Bitcoin, the world’s first and most recognized cryptocurrency, has consistently drawn attention from investors, analysts, and the media. Its fluctuations not only reflect market sentiment but also serve as an indicator of the broader economic landscape. As of October 2023, Bitcoin’s price in USD has been a hot topic, with numerous factors influencing its volatility and potential trajectory.

Current Price Trends

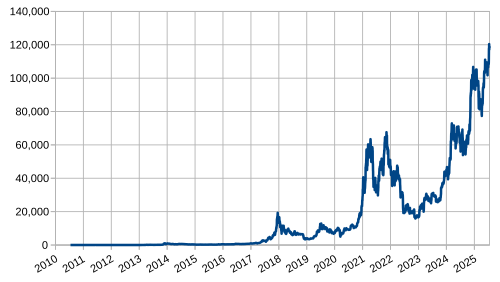

As of mid-October 2023, Bitcoin is trading at approximately $27,500 USD, a notable shift from its year-to-date fluctuations. The cryptocurrency market has experienced significant swings, with Bitcoin’s price peaking at around $69,000 in November 2021 and subsequently dipping significantly in 2022. Market analysts suggest that this volatility is attributed to various factors including regulatory news, market demand, investor sentiment, and macroeconomic indicators.

Factors Influencing Bitcoin Price

Several key elements have been identified as influencing Bitcoin’s price trajectory:

- Regulatory Developments: Recent policies from various governments around the world regarding the regulation of cryptocurrencies have created uncertainty, impacting investor confidence.

- Market Demand: Increased institutional interest and adoption have provided upward pressure on Bitcoin’s price. Major companies such as Tesla and MicroStrategy have made significant investments in Bitcoin.

- Global Economic Indicators: Economic instability, inflation concerns, and interest rates can directly affect cryptocurrency markets, often leading investors to seek alternatives like Bitcoin as a hedge.

- Technological Developments: Updates in blockchain technology and enhancements to the Bitcoin network, such as the adoption of the Lightning Network, aim to improve transaction speeds and lower costs, potentially attracting more users.

Outlook and Conclusion

The outlook for Bitcoin price in USD remains mixed. While some analysts predict a bullish trend due to potential market rallies and increasing adoption, others express caution due to regulatory pressures and market saturation. Investors are encouraged to stay informed and consider both short-term volatility and long-term potential. As the cryptocurrency landscape continues to evolve, understanding the driving forces behind Bitcoin price changes will be crucial for making informed investment decisions. For those involved in the crypto market, monitoring ongoing regulatory news, institutional interest, and technological advancements will be essential to navigate the future of Bitcoin.