Understanding BCE Stock: Performance and Future Outlook

Introduction

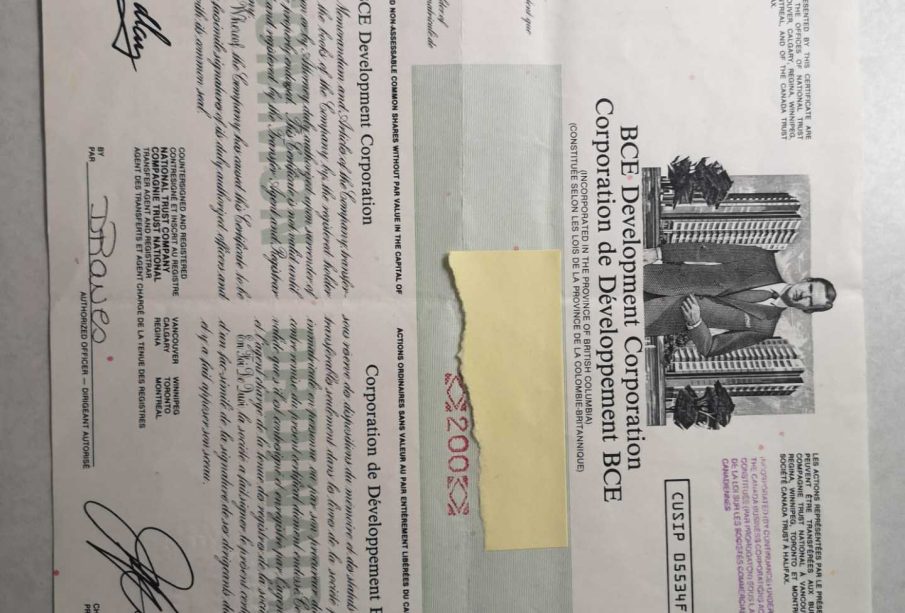

BCE Inc. is one of Canada’s largest telecommunications companies, providing a wide range of services including wireless, internet, and television. The performance of BCE stock is crucial not only for investors but also for the company’s strategic direction in the highly competitive telecom industry. As Canada continues to embrace digital communications, understanding the trends surrounding BCE stock has become increasingly relevant to both investors and economic analysts.

Current Trends in BCE Stock

As of October 2023, BCE stock has shown considerable resilience amidst economic fluctuations and industry changes. The stock has maintained a steady price, hovering around CAD 63, with a modest 4% increase year-to-date. Analysts attribute this stability to BCE’s solid market position and strong fundamentals, including significant investments in infrastructure, which are essential for enhancing service quality and expanding coverage, particularly in rural areas.

Recent Developments and Financial Performance

In its latest quarterly report, BCE announced earnings that exceeded analyst expectations, with a reported revenue growth of 3.5%. This growth can largely be credited to an uptick in wireless service subscriptions and broadband internet demand as more Canadians shift to remote work and digital solutions. Furthermore, BCE’s commitment to dividend payouts remains strong, with a current yield of approximately 5.7%, which is attractive to income-focused investors.

Market Challenges and Opportunities

However, BCE does face challenges, such as intense competition from other major players in the telecom sector, including Telus and Rogers. Additionally, regulatory pressures and the rising costs of infrastructure maintenance can impact profit margins. On the upside, the global push towards 5G technology presents a significant opportunity for BCE to differentiate itself and capture new customer segments.

Conclusion

In summary, BCE stock remains an interesting consideration for investors looking for solid returns and stability in the Canadian telecom space. The company’s ability to adapt to changing market conditions and invest in modern technology will play a critical role in its ongoing success. As telecommunications continue to be a cornerstone of modern life, BCE’s position in the market will likely fortify its stock performance in the future, making it a noteworthy option for both current and prospective shareholders.