Understanding BBAI Stock: Trends and Insights

Introduction to BBAI Stock

As technology advances and the demand for innovation in artificial intelligence (AI) continues to grow, BBAI (BigBear.ai Holdings, Inc.) has emerged as a focal point for investors. This company is dedicated to providing advanced software solutions that leverage AI and machine learning, primarily serving defense agencies and commercial markets. Understanding BBAI stock is crucial for investors looking to navigate the complexities of the tech industry.

Recent Performance and Market Trends

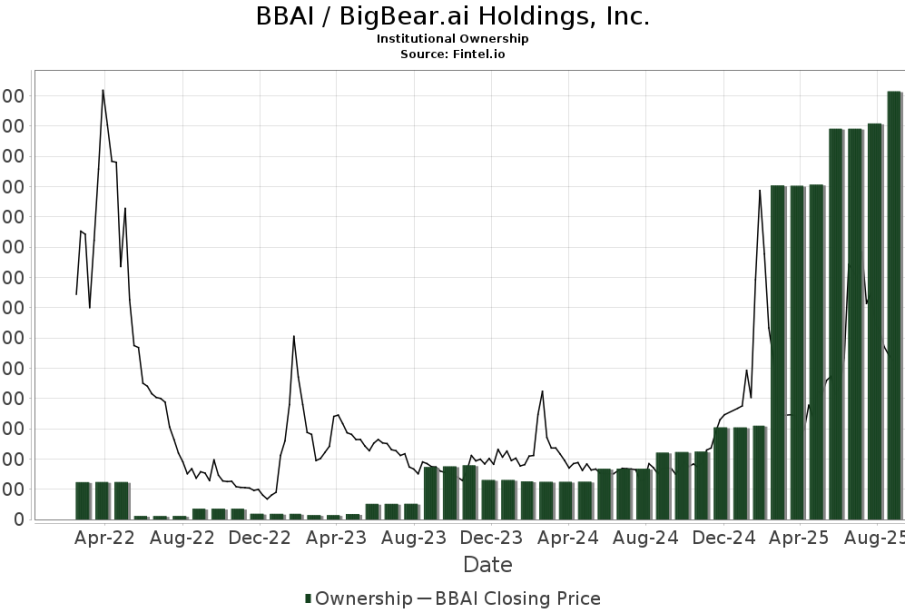

As of October 2023, BBAI stock has exhibited notable fluctuations, mirroring the overall volatility seen in tech shares recently. Following a dip in mid-September, the company’s stock recovered partly due to increased interest in AI solutions amid rising global cybersecurity threats. Investors are particularly optimistic about BBAI’s recent partnerships and contracts with federal agencies, which could lead to sustained revenue growth.

Analysts have pointed out that the stock has a current price-to-earnings (P/E) ratio of 25, which is slightly above the average ratio for tech stocks. This indicates that investors are expecting higher earnings growth in the future. Additionally, experts from financial institutions have set a target price ranging from $8 to $12 within the next year, contingent upon successful project implementations and new client acquisitions.

Future Outlook and Considerations

The integration of AI solutions into various sectors will likely bolster BBAI’s position in the market. As businesses and government entities seek enhanced data analytics and operational efficiencies, demand for the company’s products is expected to rise. Furthermore, the anticipated federal budget allocation towards defense and technology advancements may work in BBAI’s favor. However, investors should remain cautious. Economic uncertainties and changes in government regulations regarding AI technology could impact the stock’s performance.

Conclusion

In summary, BBAI stock presents an intriguing opportunity for investors interested in the intersection of technology and defense sectors. With recent developments pointing towards a positive trajectory, it is essential for investors to stay informed about market dynamics and the company’s performance. Enhanced strategic partnerships and a robust defense budget could significantly impact BBAI’s stock performance in the coming months. Keeping abreast of these factors will be crucial for making informed investment decisions.