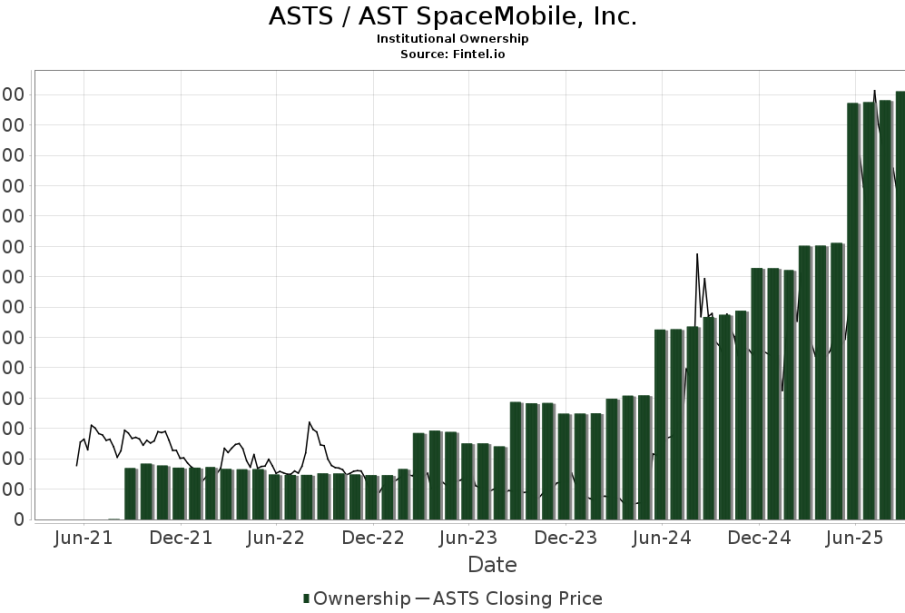

Understanding Asts Stock: Current Trends and Insights

Introduction

As the stock market continues to evolve, investors are paying close attention to the performance of various stocks, including Asts stock. Understanding the dynamics of Asts stock is crucial for investors looking to make informed decisions in a highly competitive financial environment. This article discusses recent developments, market performance, and future implications of Asts stock.

Recent Developments

In the past weeks, Asts stock has witnessed significant fluctuations in value, largely driven by changes in market sentiment and broader economic factors. Following the company’s recent quarterly earnings report, released earlier this month, Asts stock rallied initially, reflecting positive investor feedback on its performance.

The earnings report revealed a 15% increase in revenue year-over-year, driven by strong sales in the emerging markets. Investors were optimistic about the company’s strategic initiatives aimed at expanding its product offerings and geographical presence.

Market Comparison

To provide context for Asts stock’s performance, it is imperative to compare it with industry peers. Companies within the same sector have also shown varied performance. For example, while Asts has seen a rise due to promising financial results, other competitors have struggled with supply chain issues and rising operational costs.

The stock market in general has been volatile, influenced by geopolitical events and economic data. Many analysts suggest that the performance of stocks like Asts will continue to be affected by external factors, such as inflation rates and interest rate adjustments by the Bank of Canada.

Future Implications

Looking ahead, the future of Asts stock will likely be shaped by several key factors. Analysts are projecting moderate growth in the company, especially if they can sustain their revenue growth and manage costs effectively. The management’s focus on innovation and customer satisfaction could play a crucial role in maintaining investor confidence.

Furthermore, the broader economic outlook will heavily influence market performance. If the Canadian economy shows signs of recovery and consumer spending increases, Asts stock could see further gains. Investors should stay informed about macroeconomic trends and prepare for potential market volatility.

Conclusion

In summary, Asts stock presents a compelling opportunity for investors looking to diversify their portfolios. With its recent positive earnings report and strategic initiatives in place, the company seems well positioned for growth. However, investors should remain cautious and keep an eye on external economic factors that could influence market conditions. As always, thorough research and careful analysis are essential in making investment decisions.