Understanding AMD Stock: Trends and Market Insights

Introduction to AMD Stock

AMD (Advanced Micro Devices, Inc.) stock has become a focal point for investors as the technology sector experiences rapid advancements, particularly in semiconductor production. The relevance of AMD stock is underscored by the increasing demand for high-performance computing, artificial intelligence, and gaming products. With AMD’s significant developments in competition against other tech giants, understanding its stock performance is critical for investors and market analysts alike.

Recent Trends in AMD Stock

As of mid-November 2023, AMD stock has shown resilience and notable growth amidst a volatile market. Currently trading at approximately CAD $94 per share, this figure represents a significant increase of over 25% since earlier this year. The company has announced several key product launches, including advancements in their EPYC server chips and Ryzen desktop processors, which have contributed to this uptick in stock value.

Moreover, AMD’s latest partnerships with major tech players, including big names in cloud computing, have further bolstered investor confidence. The synergy created by these collaborations is expected to enhance AMD’s market share and drive future revenues.

Market Influences

A variety of factors influence AMD’s stock performance. Primarily, the global chip shortage, which has wreaked havoc on the tech industry, continues to play a crucial role in shaping demand for AMD’s products. Furthermore, the recent release of quarterly earnings revealed strong performance metrics, showcasing a year-over-year revenue growth of 20%, significantly surpassing analyst expectations.

Investors should also consider potential challenges, such as increased competition from rival companies like NVIDIA and Intel, which could impact AMD’s pricing strategies and market positioning. Additionally, external economic factors, including inflation and supply chain disruptions, remain critical considerations for future stock performance.

Conclusion and Forecast

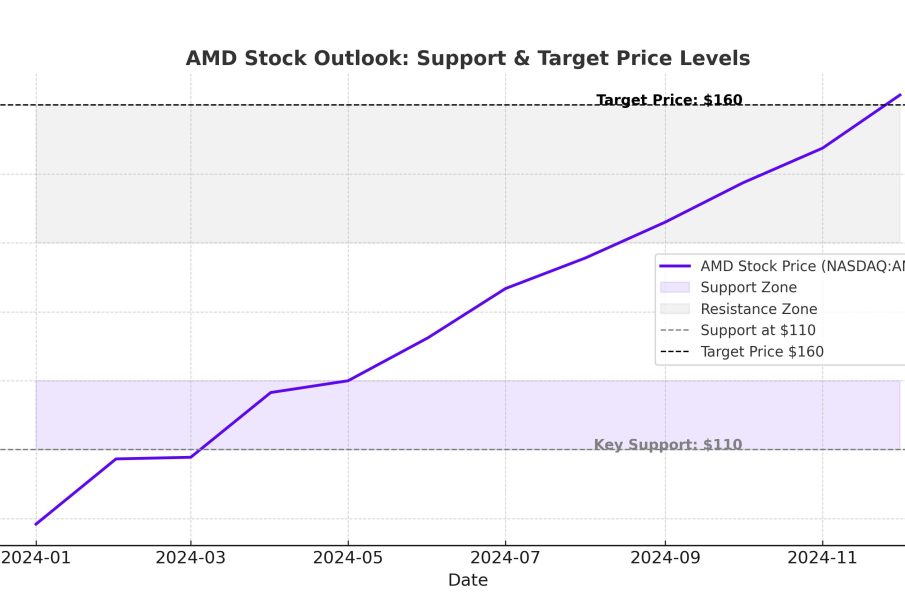

As AMD navigates through the complexities of the semiconductor industry, the stock presents both opportunities and risks for investors. With ongoing innovations and strategic partnerships, AMD appears poised for continued growth, however, it is essential for potential investors to stay informed regarding market trends and competitive landscapes. Looking ahead, analysts forecast a potential upward trajectory for AMD stock as long as the company can maintain its competitive edge and adapt to ongoing market challenges.

In conclusion, AMD stock remains an attractive option for those looking to invest in the tech sector, but careful analysis and monitoring of market conditions will be vital for making informed investment decisions.