Trends and Significance of the TSX Index in Canada

Introduction

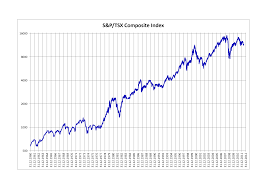

The TSX Index, or the S&P/TSX Composite Index, is a key benchmark for the Canadian stock market, representing the performance of the largest publicly traded companies in Canada. As the country navigates through various economic challenges and opportunities, understanding the trends and fluctuations in the TSX Index has become increasingly important for investors and financial analysts alike.

Recent Trends in the TSX Index

As of October 2023, the TSX Index has shown signs of resilience despite the global economic uncertainties, including inflationary pressures and geopolitical tensions. The index saw a notable uptick in the third quarter of 2023, driven by gains in the energy and financial sectors. The energy stocks rallied due to rising crude oil prices, bolstered by global demand recovery. Meanwhile, Canadian banks reported strong quarterly earnings, which added further strength to the index.

According to the latest data from the TMX Group, the TSX Index closed at 20,500 points on October 5, 2023, a significant increase from earlier in the year. Analysts note that this upward trend reflects a combination of domestic economic stability and positive global market sentiment, despite concerns about potential interest rate hikes and ongoing supply chain issues.

Factors Influencing the TSX Index

Several factors play a critical role in influencing the performance of the TSX Index. Firstly, commodity prices are pivotal, given Canada’s vast natural resources. Fluctuations in oil, natural gas, and metals directly affect the valuations of companies listed on the TSX. Moreover, macroeconomic indicators such as GDP growth, employment rates, and consumer spending trends have a profound impact on investor confidence and market movements.

Additionally, the TSX Index is sensitive to external factors, including the performance of the U.S. markets and the global economy. Changes in U.S. Federal Reserve policies and international trade agreements can create ripple effects impacting Canadian investments.

Conclusion

In summary, the TSX Index remains a crucial gauge of the Canadian economy, reflecting broader market trends and investor sentiment. As we move into 2024, analysts suggest that the index may continue to face volatility, but positive earnings reports and stable commodity prices could bolster its performance. For investors, keeping a close eye on the TSX Index will be vital in making informed decisions. Its significance extends beyond just numbers, illustrating the health of the Canadian economy and the opportunities within its financial markets.