The VIX: Market Volatility and What It Means for Investors

Introduction

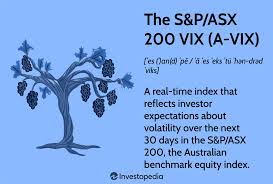

The VIX, also known as the CBOE Volatility Index, is widely regarded as a key indicator of market volatility and investor sentiment. Often referred to as the ‘fear index,’ it reflects the market’s expectations of future volatility based on S&P 500 index options. Understanding the VIX is essential for investors and traders as it provides insights into market stability and potential risk.

Recent Trends in the VIX

As of October 2023, the VIX has seen significant fluctuations correlated with economic data releases and global geopolitical events. Rising inflation concerns and interest rate adjustments by central banks have led to increased market volatility, causing the VIX to spike at times. In August and September 2023, the VIX rose sharply, reflecting investor anxiety over uncertain monetary policy and economic forecasts.

Recent reports indicate that the VIX reached a high of 28.6 during market turbulence spurred by unexpected economic forecasts. Analysts suggest that such increases in the VIX are signals for investors, indicating a potential downturn or correction in the markets. However, it is essential to consider that the VIX typically increases during bear markets and declines during bull markets.

The Importance of the VIX for Investors

Understanding the VIX is not just beneficial for traders looking to hedge their portfolios; it also offers valuable insights for long-term investors. A high VIX might indicate that it’s a good time to invest, as assets may be undervalued due to market panic, while a low VIX may suggest a steady market, but also indicate caution as historical precedents suggest a market correction could follow.

Moreover, institutional investors utilize the VIX to gauge market sentiment and adjust their strategies accordingly. For example, the VIX can inform decisions on when to enter or exit the market, as well as on the appropriate timing for asset allocation changes.

Conclusion

In conclusion, the VIX serves as a crucial barometer for market volatility, providing valuable insights for both short-term traders and long-term investors. As we move forward in 2023, keeping an eye on the VIX will be important for understanding market dynamics, especially in an increasingly unpredictable economic landscape. Investors would do well to incorporate the VIX into their analytical toolkit, as it not only signals potential market changes but also helps in crafting informed investment strategies.