The TSX Index: Importance and Recent Trends

Introduction

The Toronto Stock Exchange (TSX) Index, a crucial indicator of the performance of Canadian equities, plays a vital role in the Canadian financial landscape. As one of the largest stock exchanges in the world, its movements can significantly impact investors and the overall economy. Understanding the TSX Index is essential for anyone looking to navigate the complexities of Canadian markets, especially in today’s volatile economic climate.

Recent Performance of the TSX Index

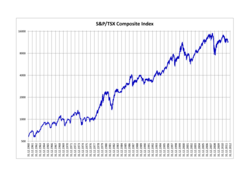

In recent months, the TSX Index has exhibited fluctuations reflecting broader economic challenges and opportunities. As of October 2023, the index has shown resilience, recovering from earlier downturns attributed to inflation concerns and geopolitical tensions. By early October, the TSX Index reached approximately 20,300 points, marking a recovery of over 10% from its low earlier in the year.

The financial and energy sectors have been significant contributors to this rebound. The energy sector, buoyed by rising oil prices due to global supply chain issues, saw companies like Suncor Energy and Canadian Natural Resources experience stock price surges. Similarly, the financial sector benefited from increasing interest rates, with banks seeing an uptick in stock performance as they adapt to higher lending rates.

Factors Influencing the TSX Index

Several factors continue to influence the TSX Index, including international economic conditions, commodity prices, and domestic fiscal policies. For instance, fluctuations in crude oil prices have a direct impact on the stock values of energy companies, which are heavily weighted in the index. Moreover, continuous monitoring of U.S. economic indicators, given that the two economies are intertwined, also plays a crucial role in predicting TSX movements.

Furthermore, the Bank of Canada’s monetary policy decisions, particularly around interest rates, have been pivotal in shaping investor sentiment. With market predictions suggesting possible hikes in interest rates to combat inflation, analysts are closely watching for shifts that could result in increased volatility in the TSX Index.

Conclusion

The TSX Index remains a barometer for healthy investments in Canada, reflecting not just corporate performance, but also the broader economic climate. As we move into the latter part of 2023, investors should stay informed about the index’s movements and the factors contributing to its fluctuations. Continued vigilance in monitoring economic indicators, both domestically and globally, will be crucial for understanding the future trajectory of the TSX Index. For investors, this is an essential period characterized by opportunity amidst uncertainty, where informed decisions can lead to fruitful outcomes.