The Nasdaq Index: A Barometer of Tech Growth in 2023

Introduction

The Nasdaq Index, often recognized as a key indicator of the technology sector’s performance, plays a pivotal role in tracking the financial market’s health. With a focus on innovative businesses, it encompasses a vast array of tech giants and emerging firms. In today’s fast-paced economic landscape, understanding the movements and trends of the Nasdaq Index is essential for investors and analysts alike.

Current Events and Insights

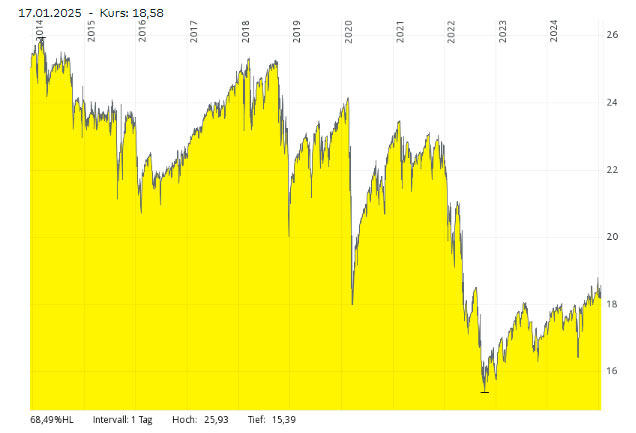

As of October 2023, the Nasdaq Index has shown remarkable resilience amidst global economic fluctuations. Recent data indicates a strong rebound in technology stocks following a tumultuous first half of the year marked by rising interest rates and inflationary pressures. In Q3, the index surged, achieving an annualized return exceeding 25% driven by robust earnings reports from companies like Apple, Microsoft, and Amazon.

The performance was also bolstered by advancements in artificial intelligence and cloud computing, which have become critical for many sectors. Consequently, the Nasdaq has not only outperformed other major indices like the S&P 500 but has also reassured investors of the technology sector’s long-term growth potential.

Market Predictions

Financial analysts project that the Nasdaq Index will continue to thrive, provided that macroeconomic conditions stabilize. Inflation concerns are gradually easing, and the Federal Reserve’s stance appears to be more accommodating. Additionally, upcoming technological breakthroughs, particularly in the fields of cybersecurity and renewable energy, are expected to attract further investments.

However, experts caution that volatility remains a possibility. Regulatory changes and geopolitical tensions could impact market dynamics, suggesting that investors maintain a cautious yet optimistic outlook.

Conclusion

The Nasdaq Index serves not only as a financial benchmark but as a reflection of broader trends in technological innovation and market confidence. As we advance into the final quarter of 2023, stakeholders should closely monitor shifts in the Nasdaq Index as it could signal potential investment opportunities or risks. Understanding its movements will be essential for anyone looking to navigate the complexities of today’s financial landscape.