The NASDAQ Composite: Importance and Current Trends

Introduction

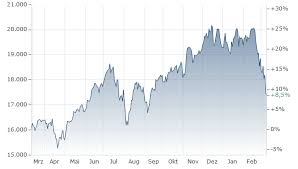

The NASDAQ Composite Index is one of the most significant stock market indices in the world, particularly known for its heavy composition of technology stocks. As the stock market landscape evolves, understanding the NASDAQ Composite becomes increasingly vital for investors and analysts alike. Tracking its performance provides essential insights into market conditions, investor sentiment, and the overall health of the economy.

Overview of the NASDAQ Composite

Founded in 1971, the NASDAQ Composite is a market-capitalization-weighted index that includes over 3,000 stocks listed on the NASDAQ stock exchange. This index is widely regarded for its representation of the technology sector, including big names like Apple, Microsoft, and Tesla. As of October 2023, the NASDAQ Composite continued to show resilience amid global economic challenges, fluctuating between gains and losses influenced by inflation rates, federal interest rate hikes, and geopolitical tensions.

Current Trends and Performance

Recent reports indicate that the NASDAQ Composite has been on a volatile path in 2023, largely due to shifting investor perceptions and economic data. As inflation displays signs of easing, many investors anticipate a calmer monetary policy approach from the Federal Reserve, leading to increased buying activity in tech stocks. This rebound has contributed to a surge in the index, which was recently reported at approximately 13,000 points, marking a significant recovery from bear market conditions seen in late 2022.

Moreover, the impact of emerging technologies, particularly in artificial intelligence and electric vehicles, continues to attract interest and investment. Companies leading these sectors have largely driven the index’s recent upswing, with their stock valuations indicating growing confidence from market participants.

Conclusion

The NASDAQ Composite Index remains a crucial barometer for investors to gauge market trends and economic conditions. As we move further into 2023, its performance will likely reflect shifting dynamics in the technology sector and broader financial markets. Investors should keep a close eye on the index, especially in light of changing interest rates and ongoing technological innovations. Understanding the fluctuations of the NASDAQ Composite could enhance investment strategies and provide foresight into future market movements.