The Latest Trends in PayPal Stock

Introduction

PayPal Holdings, Inc. is a leading digital payments platform that has transformed the way consumers and businesses transact online. As of October 2023, PayPal’s stock (NASDAQ: PYPL) is under close scrutiny not only by investors but also by market analysts trying to forecast its future in a rapidly evolving financial technology landscape. Understanding the trends and performances of PayPal stock is imperative for investors aiming to navigate the complexities of the stock market.

Current Performance

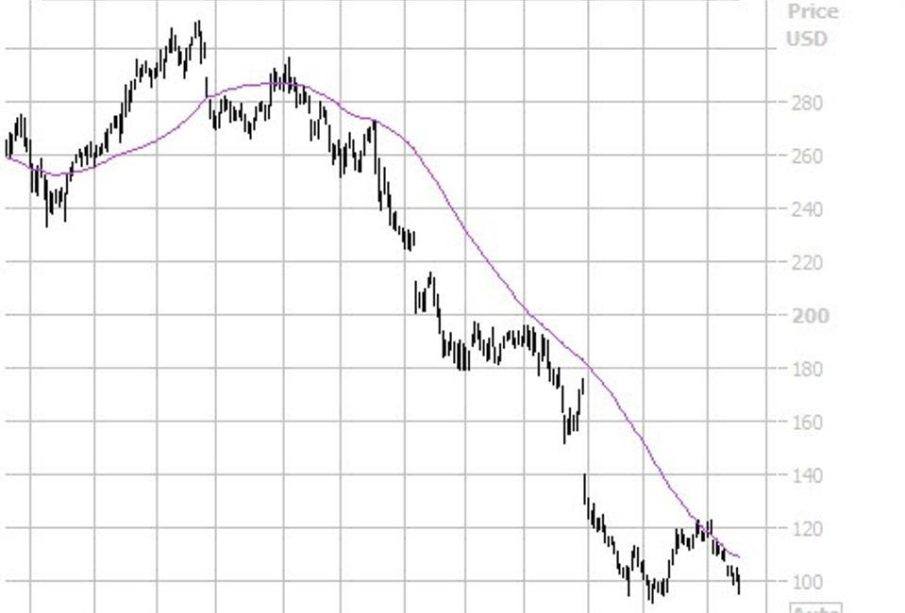

As of mid-October 2023, PayPal’s stock has shown signs of volatility, reflecting broader market conditions and shifts in consumer behavior post-pandemic. After hitting an all-time high of $308.53 in July 2021, the stock has experienced significant fluctuations, mainly due to heightened competition in the digital payment space and regulatory pressures worldwide. Recently, PayPal shares have rallied slightly, closing at $75.43 on October 12, 2023, following the company’s release of optimistic earnings forecasts.

Market Influences

The performance of PayPal stock has been influenced by several critical factors, including the company’s recent strategic announcements and partnerships. In September 2023, PayPal unveiled a new feature that allows users to buy, hold, and sell cryptocurrencies directly within the PayPal app. This move not only aims to increase user engagement but also aligns with the growing interest in digital assets among consumers.

Additionally, competition from tech giants like Apple and Square (now Block, Inc.) has intensified, compelling PayPal to enhance its offerings continually. Analysts are predicting that the integration of innovative features such as online shopping loans and buy-now-pay-later options could provide much-needed momentum for PayPal’s stock in the upcoming quarters.

The Path Forward

Looking ahead, experts remain cautiously optimistic about PayPal’s stock. Many analysts have a ‘hold’ rating on the stock but are closely monitoring its performance, especially as the holiday shopping season approaches. The increased digital transactions during this period could positively impact revenue growth.

In summary, while PayPal stock has faced challenges in recent years, its ongoing innovations and strategic adjustments may position it for future growth. For investors, staying informed on developments in both the company’s strategies and the overall market will be crucial in making investment decisions surrounding PayPal stock.