The Latest Trends and Insights on AMC Stock

Introduction

AMC Entertainment Holdings Inc., known for its chain of movie theaters, has seen significant volatility in its stock price over the last few years. As one of the most discussed stocks on social media and financial forums, AMC stock has emerged as a focal point for retail investors, particularly in the wake of the pandemic’s impact on the film industry. Understanding AMC’s performance is crucial not just for investors looking to buy or sell, but for anyone interested in the evolving landscape of entertainment and finance.

Recent Market Movements

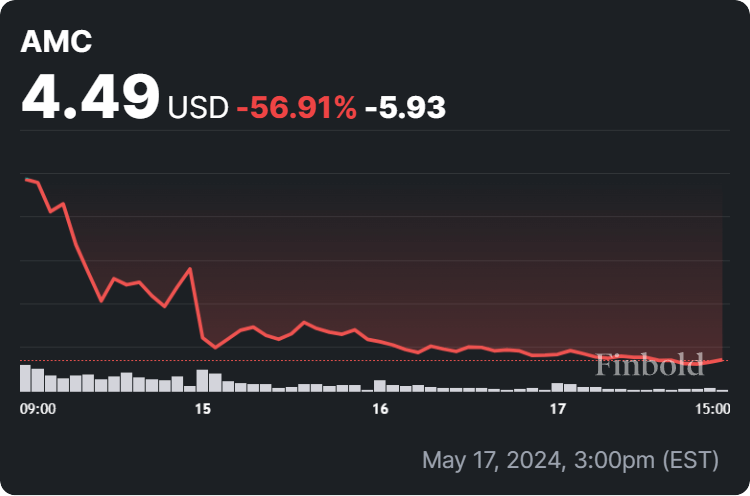

As of October 2023, AMC stock is trading at approximately $8.75, down from highs of over $70 in June 2021. This decline reflects broader market trends and specific challenges faced by the entertainment sector, including changes in consumer behavior and competition from streaming services. Analysts are currently evaluating the implications of recent financial reports from AMC, which indicated a decline in cinema attendance and ongoing debt struggles.

In the last quarter, AMC reported revenues of $1.2 billion, beating analyst expectations, but still showcasing losses due to rising operational costs and stagnant box office performance compared to pre-pandemic levels. The company’s plans to diversify its offerings, such as introducing additional in-theater experiences and exploring partnerships, have been seen as vital steps toward recovery.

Investor Sentiment and Retail Influence

Retail investors have been significantly influential in the stock’s journey, utilizing platforms such as Reddit and Twitter to organize buying sprees that drove the price up earlier this year. The ‘meme stock’ phenomenon, where stocks gain popularity mainly through social media buzz, has kept AMC in the spotlight, allowing it to remain relevant despite falling revenue numbers.

Following the recent rise in interest rates and a wider market correction, discussions surrounding AMC stock have surfaced again, with investors pondering whether a strong buying opportunity exists or if waiting might yield better results. Sentiment on forums indicates a divided opinion, with some believing in long-term growth prospects tied to recovery in the movie industry.

Conclusion

AMC stock serves as an essential case study of how social media can influence market movements and investor behavior. For those considering investing in AMC, understanding the dynamics of the entertainment industry, market fluctuations, and the influence of retail investors is imperative. While caution is warranted given recent declines, optimistic projections suggest that if the company can continue to innovate and adapt, AMC could eventually regain traction in the market. As the film industry slowly recovers from the pandemic effects, AMC’s actions in the coming months will be critical to watch.