The Importance of VIX Stock in Today’s Financial Landscape

Introduction

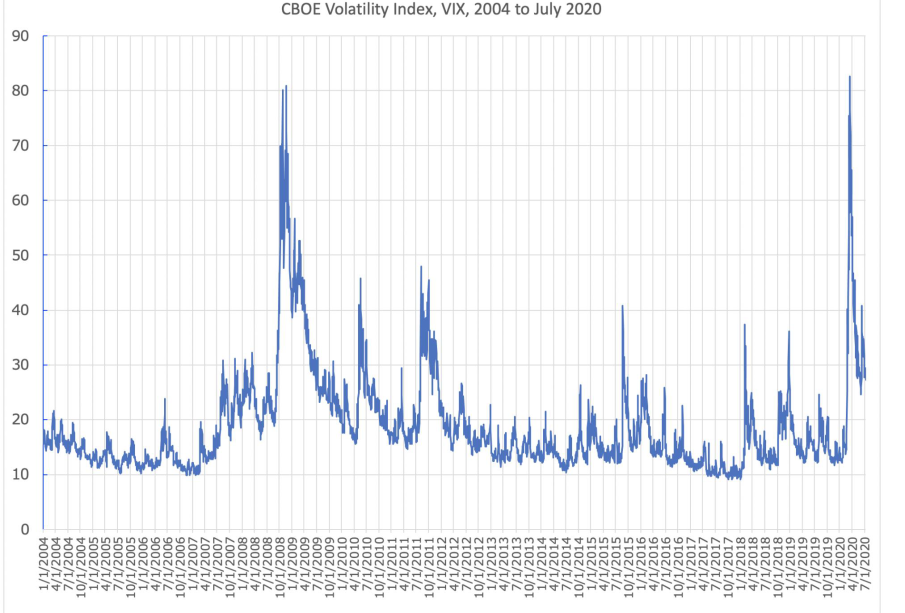

The VIX stock, often referred to as the ‘fear gauge,’ represents the market’s expectations for volatility based on S&P 500 index options. Its relevance has sharply increased amid recent market fluctuations and economic uncertainties. Understanding VIX stock is crucial for investors seeking to gauge market sentiment and make informed trading decisions.

What is VIX Stock?

The CBOE Volatility Index (VIX) calculates the expected volatility of the S&P 500 index over the next 30 days. It is derived from the prices of options on the S&P 500, reflecting investor sentiment and anticipated future market behavior. A rising VIX usually indicates growing uncertainty or fear in the market, while a declining VIX suggests more stability and investor confidence.

Recent Trends and Events

In recent months, the VIX has experienced significant fluctuations as global economic factors such as inflation, interest rates, and geopolitical tensions have introduced considerable uncertainty. For instance, as of October 2023, the VIX has shown spikes corresponding with major economic reports that have led to market sell-offs. In early October, news of higher-than-expected inflation data caused the VIX to surge, indicating increased market anxiety.

On the other hand, after the announcement of favorable US employment data, the VIX experienced a drop, reflecting a fleeting sense of security among investors. Analysts note that such volatility showcases the importance of monitoring the VIX, not just for options traders but also for all market participants.

Implications for Investors

Investors can use VIX stock as a tool for risk management. When VIX levels are high, it’s often seen as an opportunity for hedging against potential downturns. Conversely, during periods of low volatility, options strategies can become less expensive, enabling investors to capitalize on upward trends. Additionally, the VIX stock can be traded using various investment products, including futures and exchange-traded funds (ETFs), offering flexible ways to gain exposure to market volatility.

Conclusion

In conclusion, VIX stock plays a vital role in understanding market dynamics and investor behavior. As economic conditions fluctuate, keeping an eye on the VIX can provide valuable insights for making reasoned investment choices. The ongoing volatility, driven by economic indicators and global events, signifies that the VIX will remain a critical element in financial markets, serving as a barometer for market sentiment amid uncertainty.