The Importance of Stock Market Graphs in Investing

Introduction

Stock market graphs are essential tools for investors and analysts alike, providing a visual representation of market trends, stock performance, and investment opportunities. As the financial landscape evolves with rapid technological advancements, understanding these graphs has never been more critical for both new and experienced investors. They allow for informed decision-making in a volatile environment, helping individuals navigate the complexities of the stock market.

Key Trends in Stock Market Graphs

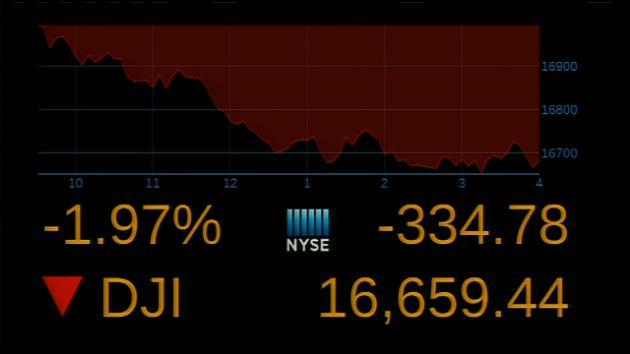

In recent weeks, stock market graphs have reflected notable fluctuations influenced by various factors including interest rate changes, inflation reports, and geopolitical tensions. For instance, the recent volatility in technology stocks, specifically in the wake of inflation concerns, has driven many investors to closely examine trend lines and moving averages. Analysts are particularly focused on the patterns that emerge from these graphs, such as bullish or bearish trends, which can signal the right time to buy or sell.

Components of Stock Market Graphs

Understanding a stock market graph involves recognizing its key components, including:

- Candlestick Patterns: These provide insights into the price movements of a stock over a specific period, showing the open, high, low, and close prices.

- Volume Indicators: This component measures how many shares were traded, giving clues about the strength of a price movement.

- Moving Averages: These lines smooth out price data to help identify the direction of the trend, filtering out the noise from short-term fluctuations.

The Current Landscape

As of October 2023, significant events impacting the stock market include Federal Reserve announcements regarding interest rates and earnings reports from major corporations. For example, after the most recent Federal Reserve meeting, stock market graphs indicated a sharp increase in volatility as investors reacted to the guidance provided. Notably, sectors like technology and consumer goods exhibited varied performance, revealing the intricate relationship between market sentiment and economic indicators.

Conclusion

In conclusion, stock market graphs serve as a vital resource for making informed investment decisions in today’s dynamic financial environment. By adapting to new trends and understanding the equations behind these visual tools, investors can better predict market behavior and increase their chances of achieving favorable outcomes. The ability to read and interpret these graphs will likely continue to play a pivotal role in shaping investment strategies and reactions to economic shifts in the future.