The Importance of QQQ in Today’s Financial Markets

Introduction

As the technology sector continues to evolve rapidly, the Invesco QQQ Trust (known as QQQ) has emerged as a significant player in the stock market and an essential tool for investors. Tracking the performance of the Nasdaq-100 Index, QQQ provides exposure to the largest non-financial companies listed on the Nasdaq stock exchange. This exchange-traded fund (ETF) has gained popularity, particularly among those looking to capitalize on tech and growth stock trends.

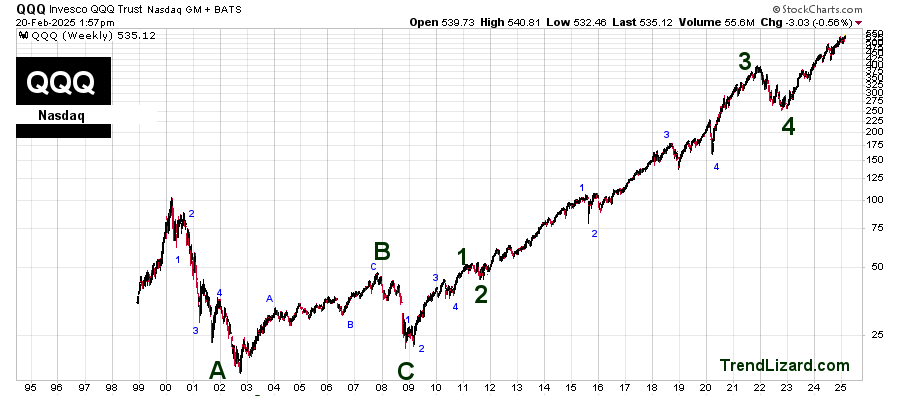

Recent Performance of QQQ

Since the beginning of 2023, QQQ has experienced notable performance, largely due to advancements in technology and a rebound from previous market dips. According to financial reports, QQQ saw a growth of approximately 25% in the first half of the year, driven by surging stocks in the artificial intelligence (AI) and cloud computing sectors. Tech giants such as Apple, Amazon, and Microsoft significantly contribute to QQQ’s performance, making it a preferred choice for many investors.

Market Trends and Data

A recent analysis by FactSet indicates that the technology sector comprises over 60% of QQQ’s holdings, underscoring its focus on innovation-driven companies. This concentration has led to increased volatility, with QQQ responding sharply to market news or earnings reports from major constituents. For instance, during the latest earnings season, strong quarterly results from companies like Alphabet and NVIDIA propelled QQQ higher, further solidifying investor confidence.

However, with rising interest rates and potential economic uncertainty, analysts advise caution. Some experts believe that while QQQ offers substantial growth potential, the inherent risks associated with tech stocks necessitate a balanced investment approach. Diversifying portfolios by combining QQQ with other asset classes might mitigate some of these risks.

Conclusion

The ongoing fluctuations in the stock market, paired with QQQ’s performance, highlight the ETF’s significant role in contemporary investment strategies. As investors seek growth opportunities, understanding the dynamics of QQQ becomes critical. Forecasts suggest that while QQQ will continue to experience growth, the market’s inherent volatility necessitates strategic planning. Consequently, for potential investors, keeping an eye on QQQ could prove beneficial in navigating the complexities of today’s financial landscape.