The Importance of Obtaining a Mortgage Quote

Introduction

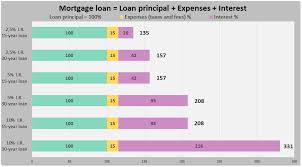

In today’s ever-changing real estate market, obtaining a mortgage quote is a critical step for anyone looking to purchase a home or refinance an existing mortgage. A mortgage quote provides a detailed breakdown of the costs involved in securing a mortgage, including interest rates, fees, and the terms of the loan. In a climate where interest rates can fluctuate significantly, understanding what a mortgage quote entails can not only save prospective homeowners money but also help them make informed financial decisions.

Your Mortgage Quote: What to Expect

When you request a mortgage quote, lenders typically evaluate your financial situation, taking into account your credit score, income, and debt-to-income ratio. This information allows them to provide you with a personalized quote tailored to your financial capacity. As of October 2023, the Bank of Canada has reported that the average mortgage rates in the country are hovering around 5.4%, subject to change based on economic conditions and the lender’s criteria.

Types of Mortgage Quotes

There are generally two types of mortgage quotes: written and verbal. While verbal quotes can offer a quick overview, written quotes are often more detailed and serve as a formal document that outlines the proposed mortgage terms. More importantly, written quotes give borrowers a leverage point in negotiations with lenders, as they display explicit rates and fees, allowing potential homeowners to compare offers efficiently.

The Importance of Comparing Quotes

Obtaining multiple mortgage quotes from various lenders is crucial. A report from the Canadian Mortgage and Housing Corporation highlighted that homeowners who compared at least three quotes were able to secure an average savings of $5,000 over the lifespan of their mortgage. By shopping around, potential buyers can explore different products and lenders, ultimately finding the best deal that fits their needs.

Conclusion

The process of obtaining a mortgage quote may seem daunting, but it is a vital step in making one of the most significant financial investments in your lifetime. As interest rates fluctuate and the real estate market continues to evolve, taking the time to understand the details and compare different mortgage quotes can lead to substantial savings. For future homeowners, consulting with financial advisors and mortgage brokers can also provide additional insights that help clarify the landscape of mortgage options available in Canada.