The Importance of Obtaining a Mortgage Quote

Introduction to Mortgage Quotes

In the current economic climate, understanding mortgage quotes has become increasingly important for prospective homebuyers in Canada. A mortgage quote provides essential information regarding loan terms, interest rates, and monthly payments, which can significantly impact a buyer’s financial decisions. With fluctuating interest rates and varying lender policies, an accurate and comprehensive mortgage quote is necessary for making informed choices about purchasing a home.

What is a Mortgage Quote?

A mortgage quote is a document provided by a lender that outlines the estimated terms of a mortgage loan. This includes the interest rate, loan amount, repayment period, and other relevant fees. It serves as a preliminary estimate that allows borrowers to compare offers from different lenders. Typically, a quote can change based on the borrower’s creditworthiness, the type of mortgage, and whether the lender has a particular interest in securing the loan.

Why Getting a Mortgage Quote is Crucial

When house hunting, obtaining a mortgage quote is one of the first steps potential buyers should take. Not only does it provide clarity on what they can afford, but it also helps in budgeting for additional costs like property taxes and homeowner’s insurance. Furthermore, securing a mortgage quote early in the search can establish trust between the buyer and lender, highlighting the buyer’s seriousness in pursuing a property.

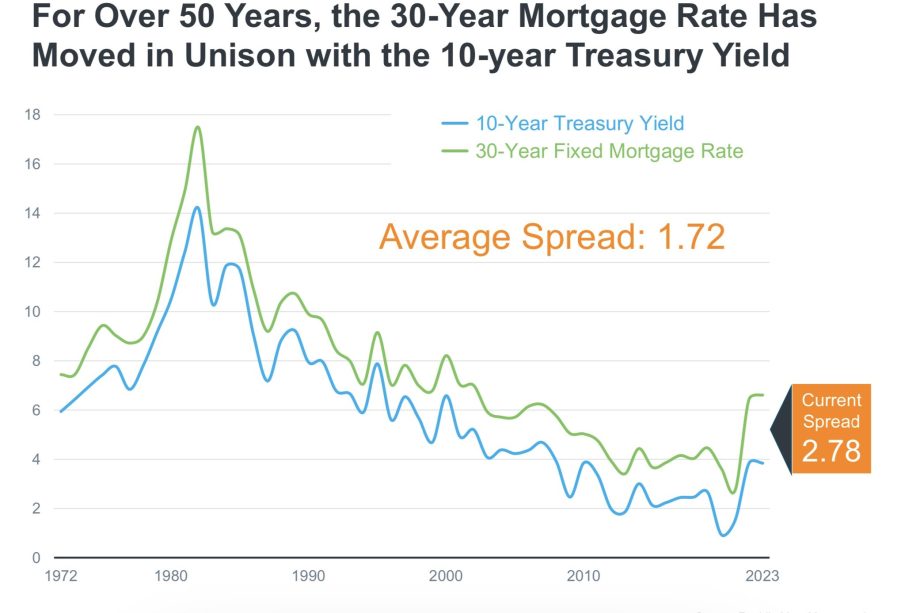

Current Trends in Mortgage Quotes

As of October 2023, mortgage rates in Canada have seen a slight decline, making it a favorable time for potential buyers to seek quotes. According to data from the Bank of Canada, the average interest rate for a fixed-rate mortgage has decreased to around 4%, compared to over 5% earlier in the year. This drop has encouraged first-time buyers to enter the market. Additionally, borrowers are exploring alternative mortgage products, such as variable-rate mortgages, to take advantage of lower initial rates.

How to Obtain the Best Mortgage Quote

To obtain a competitive mortgage quote, buyers should shop around and compare multiple lenders. It’s advisable to check both large banks and local credit unions, as interest rates and terms can vary significantly. Utilizing online mortgage calculators and consulting with mortgage brokers can also aid in understanding the terms being offered. Moreover, ensuring a strong credit score can greatly improve the chance of receiving favorable terms.

Conclusion

Obtaining a mortgage quote is a critical step in the home buying process. As market conditions fluctuate, understanding the elements of a mortgage quote can safeguard buyers against rising interest rates and potential financial pitfalls. In light of the recent trends indicating lower mortgage rates, now may be an ideal time for prospective homeowners in Canada to secure a mortgage quote and take that exciting step toward homeownership.