The Importance of Financial Companies in Today’s Economy

Introduction

Financial companies play a critical role in the global economy by providing essential services such as banking, investment, risk management, and financial advice. Their influence stretches far beyond their immediate functions as they help facilitate trade, contribute to liquidity, and enable individual wealth accumulation. Understanding the ongoing developments and regulations in this sector is vital, especially given the increased scrutiny following financial crises and the rapid technological advancements reshaping the industry.

Current Trends in the Financial Sector

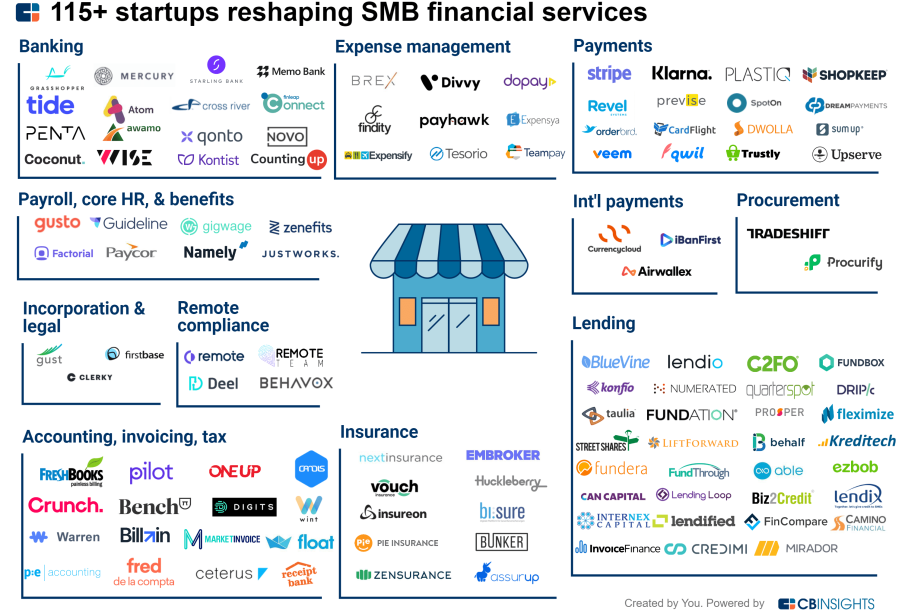

As of 2023, financial companies are experiencing significant transformations driven by digital innovation, regulatory changes, and evolving consumer preferences. The rise of fintech (financial technology) companies has disrupted traditional banking and investment models, making financial services more accessible to a larger segment of the population. Solutions like mobile banking, peer-to-peer lending, and robo-advisors are continuously gaining popularity.

Moreover, regulatory bodies worldwide are adapting to these changes by implementing new measures that promote transparency and protect consumers while fostering competitive markets. For example, in Canada, the Office of the Superintendent of Financial Institutions has been working on frameworks to ensure that both traditional banks and fintech startups operate under similar regulatory standards to mitigate risks.

Impact of Recent Economic Challenges

The COVID-19 pandemic and subsequent economic recovery phase have tested financial companies significantly. Many institutions in Canada and globally have had to adapt to economic uncertainty and shifting consumer behaviors, such as increased savings rates and a demand for enhanced digital services. Financial companies that have successfully leveraged technology have seen a jump in customer engagement and retention, which is essential in a time of economic strain.

Future Outlook for Financial Companies

The future of financial companies seems poised for further innovation, driven by data analytics, artificial intelligence, and machine learning. These technological advancements are expected to streamline operations, improve risk management, and enhance the customer experience. Additionally, a significant focus on sustainability and responsible investing is likely to reshape how financial companies operate and compete in the market.

Conclusion

As the landscape of financial companies evolves, both consumers and businesses must stay informed about the emerging trends and challenges in the sector. The intertwining of technology and finance represents not only significant opportunities for growth and accessibility but also pose risks that require careful navigation. Stakeholders should keep a close eye on regulatory changes and continue to innovate to meet the needs of a diverse clientele. Ultimately, the ability of financial companies to adapt and thrive will be paramount in driving economic growth in the coming years.