The Impact of Scott Bessent on Modern Investment Strategies

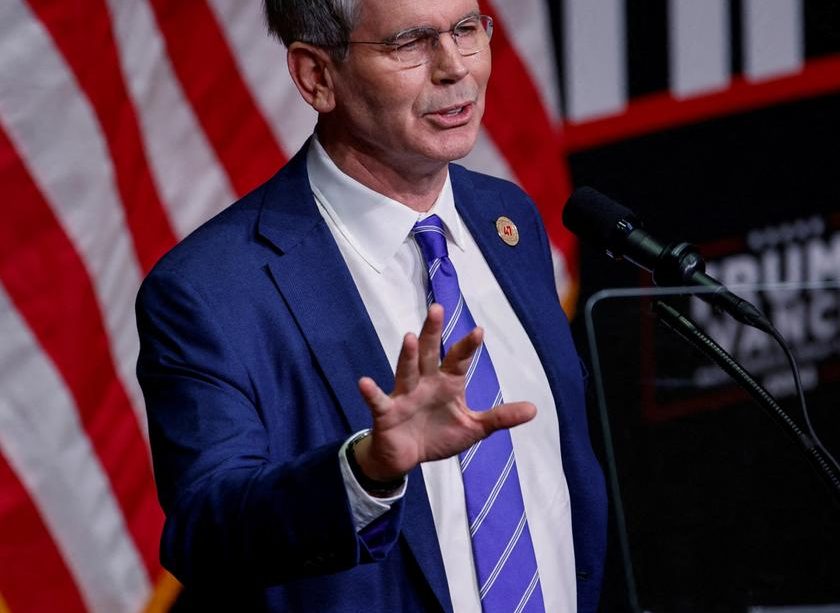

Introduction to Scott Bessent

Scott Bessent has emerged as a prominent figure in the finance industry, bringing a wealth of experience as an investor and strategist. As the founder and CEO of Key Square Group, his approach integrates innovative investment techniques with a deep understanding of global markets. His influence within investment circles makes his insights particularly relevant in today’s volatility and shifts in economic landscapes.

Career Highlights

Bessent has a distinguished background, having played significant roles at some of the most respected financial institutions in the world. Early in his career, he gained experience at investment firms such as Moore Capital Management, where he sharpened his skills in macroeconomic strategies. Bessent later served as the Chief Investment Officer for Soros Fund Management, working under the mentorship of famed investor George Soros. This position enabled him to pioneer investment strategies that have had lasting impacts across various sectors.

Current Insights and Market Analysis

Recently, Bessent has voiced his insights on the ongoing fluctuations in the global economy, particularly stressing the importance of adaptability in investment approaches. In a recent conference, he highlighted how current monetary policies and geopolitical tensions can shape market dynamics and urged investors to remain vigilant and responsive. His advocacy for diversification and risk management resonates with both new and seasoned investors, providing them with a roadmap to navigate financial uncertainties.

Future Projections

Looking ahead, Bessent believes that the future of investment will be strongly tied to technological advancements and sustainable practices. With the rise of artificial intelligence and blockchain technology, he argues that investors must harness these innovations to drive growth. His predictions suggest that sectors embracing sustainability will outperform traditional markets, establishing a trend that investors should consider in their strategic planning.

Conclusion

Scott Bessent’s work continues to shape modern investment strategies, emphasizing a balanced and informed approach to financial decision-making. As the market landscape evolves, his insights provide a crucial understanding of potential opportunities and challenges that lie ahead. For investors, following Bessent’s guidance could be pivotal in achieving resilience and adaptability in a constantly changing economic environment.