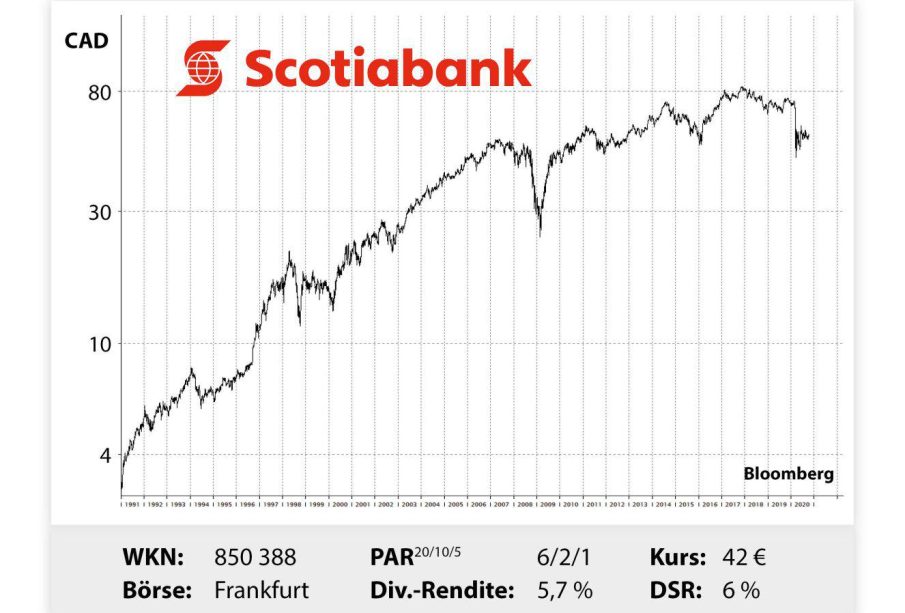

The Impact of Scotiabank on Canada’s Financial Landscape

Introduction

Scotiabank, one of Canada’s largest banks, plays a vital role in the financial sector, influencing economic growth and consumer banking in the country. Founded in 1832, Scotiabank has grown to become a key player not only in Canada but globally, offering services in various markets. Understanding Scotiabank’s operations, recent developments, and customer impacts is essential for grasping the current state of the Canadian banking industry.

Recent Developments

In October 2023, Scotiabank announced its latest quarterly earnings, reporting a significant increase in profits driven by strong performance in their international operations. The bank’s net income reached $2.6 billion, reflecting a 12% increase compared to the previous year. This growth was attributed to higher interest rates and robust demand for loans across personal and business spectrums.

Additionally, Scotiabank has been making strides in the digital banking space. In September 2023, they launched a new mobile banking app, aimed at enhancing customer experience through improved usability and innovative features, such as AI-powered financial advice and personalized budgeting tools. This aligns with their strategy to meet the changing needs of consumers who increasingly prefer digital interactions over traditional banking methods.

Community Engagement

Scotiabank continues to show commitment to social responsibility through various community engagement initiatives. In October 2023, they announced a $10 million investment aimed at supporting local businesses and entrepreneurs in underserved communities. This initiative is geared towards fostering economic recovery and stimulating job creation in the wake of the pandemic’s impact.

Conclusion

As Scotiabank moves forward, its influence on the Canadian banking landscape remains significant. The recent financial success highlights the bank’s resilience and adaptability in a changing economic environment. Furthermore, their focus on technology and community support demonstrates a strategy that seeks to create a positive impact on both customers and society. Looking ahead, continuous innovation and commitment to customer service will likely define Scotiabank’s trajectory as it navigates the evolving financial landscape.