The Consumer Price Index (CPI) and Its Impact on Canada

Introduction to the Consumer Price Index

The Consumer Price Index (CPI) is a crucial economic indicator that measures the average change over time in the prices paid by consumers for a basket of goods and services. As one of the primary gauges of inflation in Canada, CPI plays a significant role in economic policy, affecting interest rates, wages, and overall economic health. Understanding CPI is essential for Canadians, as it directly influences purchasing power and economic decisions.

Current Trends in CPI

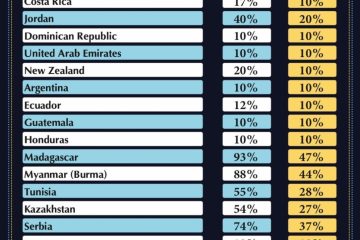

As of October 2023, Canada has experienced notable fluctuations in its CPI. The most recent data from Statistics Canada revealed that the inflation rate was 4.1%, marking a decrease from previous months, where inflation rates reached as high as 8%. The rise in CPI earlier this year was driven by increased costs for food, energy, and housing. However, a combination of supply chain improvements and changes in consumer demand have contributed to the recent stabilization in prices.

Separate sectors are affected differently by changes in CPI. For instance, food prices have consistently risen due to ongoing supply chain disruptions and agricultural challenges, while energy prices have shown signs of stabilizing after soaring earlier in 2023. Such variations highlight the necessity for consumers and policymakers to stay informed about the CPI and its constituents.

The Broader Economic Context

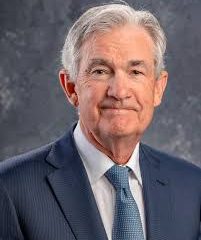

The Bank of Canada closely monitors CPI when making decisions regarding monetary policy to maintain stable inflation targets. In reaction to the elevated inflation rates observed earlier in the year, the Bank raised its key interest rates multiple times. However, the recent moderating CPI may suggest that further rate increases might be on hold as officials reassess economic conditions. This delicate balance is crucial for sustaining economic growth while controlling inflationary pressures.

Conclusion and Implications for Canadians

The importance of CPI extends beyond mere numbers; it impacts the day-to-day lives of Canadians by influencing purchasing decisions and cost of living. As inflation moderates, Canadians can anticipate potential relief in their expenses, but continuous vigilance is warranted as economic conditions change. Looking ahead, analysts predict that with effective monetary policies and recovery in supply chains, the CPI may stabilize further, bringing more predictability to the Canadian economy.

In summary, keeping an eye on CPI trends will allow Canadians to navigate their finances better and understand the economic landscape as it evolves.