The Canada Pension Plan: Key Insights and Updates

Introduction

The Canada Pension Plan (CPP) is a vital social insurance program that provides financial support to Canadians during retirement. As one of the cornerstones of Canada’s social security system, the CPP plays an essential role in ensuring that retirees have a measure of income after their working years. With ongoing discussions about pension adequacy and recent policy changes, understanding the CPP has become increasingly important for Canadians planning their financial futures.

Overview of the Canada Pension Plan

The Canada Pension Plan was established in 1966, aiming to provide a dependable source of income for workers and their families. The program is funded through mandatory payroll contributions from employees and employers, with current contribution rates set at 5.45% of pensionable earnings.

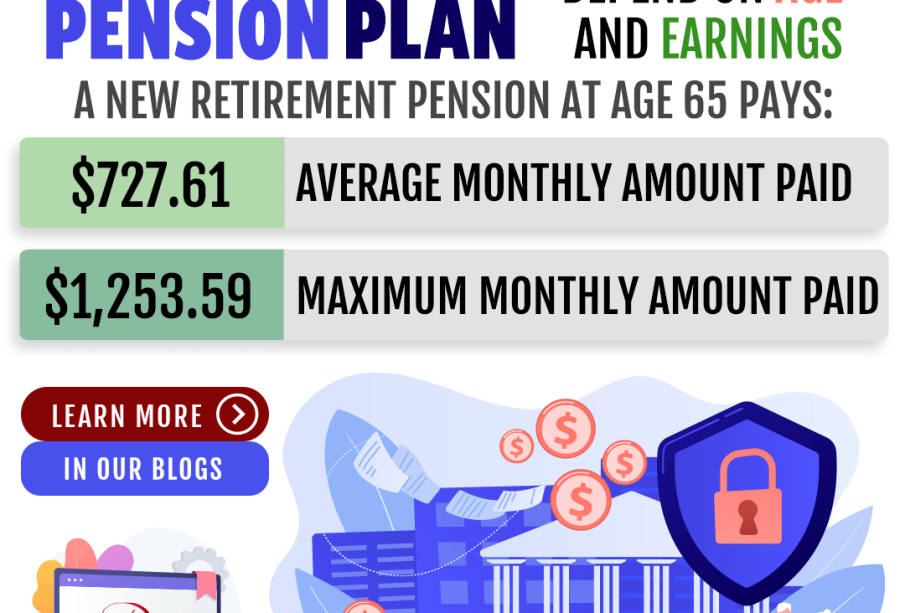

The amount eligible Canadians receive upon retirement depends on how much they contribute and for how long. As of 2023, the average monthly payment for seniors is approximately CAD 1,175, with maximum payouts reaching up to CAD 1,306 for those who qualify. Furthermore, the CPP also provides disability benefits and survivor benefits to eligible contributors’ families.

Recent Changes and Their Implications

Recently, the Canadian government has implemented some adjustments to the Canada Pension Plan to enhance its sustainability and adequacy. In 2021, a gradual increase to the CPP contribution rates was announced, aimed at increasing future benefits. By 2025, contributions will have risen by one percentage point, increasing both employer and employee contributions. This change is designed to ensure that the CPP can support an aging population over the coming decades.

Moreover, the aim is to provide increased monthly benefits by 40% by the time contributors retire in 2065. This reflects a recognition of the rising costs of living and the need for a more robust financial foundation for retirees.

Conclusion

As the Canada Pension Plan continues to evolve, it remains a crucial element of financial security for millions of Canadians. With proposed enhancements aimed at increasing benefits and the necessary adjustments to contribution rates, the CPP is well-positioned to meet the challenges of an aging population and rising living costs. For Canadians, staying informed about these changes could significantly impact retirement planning strategies. Being proactive in understanding how the CPP works can ultimately lead to better financial outcomes in the future.