Tag: Taxation

Understanding GST HST Payments in Canada

Introduction The Goods and Services Tax (GST) and Harmonized Sales Tax (HST) are critical components of Canada’s tax system, impacting both consumers ...Revenu Québec: Gestion fiscale et services aux citoyens

Introduction à Revenu Québec Revenu Québec joue un rôle crucial dans la gestion du système fiscal provincial, s’assurant que les résidents, les ...Exploring the Importance of Income Tax in Canada

Introduction Income tax is a vital aspect of the Canadian economy, serving as the primary source of revenue for both federal and ...Comprendre Revenu Canada et Ses Changements Récents

Introduction Revenu Canada, l’agence de collecte des impôts au Canada, joue un rôle crucial dans le fonctionnement économique du pays. En tant ...Revenu Québec: Un Pilier de la Gestion Fiscale au Québec

Introduction Revenu Québec joue un rôle essentiel dans la gestion des finances publiques de la province. En tant qu’organisme responsable de la ...Understanding Capital Gains Tax in Canada: 2023 Updates

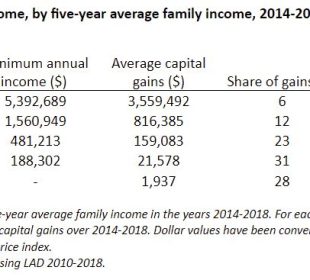

Introduction Capital gains tax is a critical aspect of the Canadian tax system, impacting numerous taxpayers as they consider the sale of ...An Overview of Capital Gains Tax in Canada

Introduction Capital gains tax is a significant topic for investors and homeowners in Canada, influencing financial planning and investment strategies. As many ...Exploring the Canada Revenue Agency’s Role in Taxation

Introduction The Canada Revenue Agency (CRA) plays a crucial role in the financial landscape of Canada, overseeing tax collection, benefits administration, and ...Ontario Tax Rebate Cheques: What You Need to Know

Introduction As the cost of living continues to rise, the Ontario government has taken measures to provide financial relief to its residents ...