Super Micro Computer Stock Tumbles on Earnings Miss, But Maintains Strong AI Infrastructure Position

Market Performance and Recent Developments

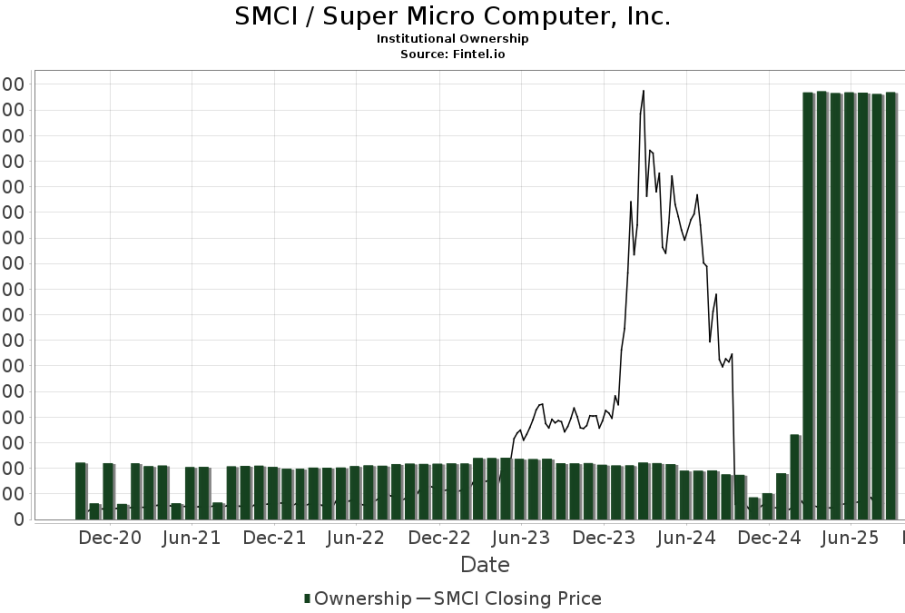

Super Micro Computer stock (NASDAQ:SMCI) has experienced a significant decline of approximately 23% over the last five trading sessions, bringing the price down to about $45 per share following disappointing Q4 2025 earnings results.

Financial Performance

For the fiscal year 2025, Super Micro Computer achieved revenue of $21.97 billion, representing a substantial increase of 46.59% compared to the previous year’s $14.99 billion. However, earnings showed a decline of 9.01%.

The company’s fourth-quarter results fell short of analyst expectations, with revenue reaching $5.76 billion and earnings per share of 41 cents. The company’s gross margin declined to 9.6%.

Market Position and Future Outlook

Super Micro Computer maintains a strong position in delivering rack-scale solutions optimized for various workloads, including artificial intelligence and high-performance computing. The company serves enterprise data centers, cloud service providers, and edge computing sectors, including 5G Telco, Retail, and embedded applications.

Despite the recent sell-off, analysts note that the company maintains strong AI infrastructure positioning, a robust balance sheet, and leadership in liquid-cooled, rack-scale systems for Blackwell-class AI factories.

Analyst Perspectives

According to 18 analysts, the average rating for SMCI stock is “Buy,” with a 12-month stock price target of $46.81, suggesting a potential increase of 14.79% from current levels.

The broader analyst community has set an average 12-month price target of USD50.0625, with estimates ranging from a low of USD15 to a high of USD93.

Market Impact

As a large-cap company with a market capitalization between $10 billion and $200 billion, Super Micro Computer currently maintains a market value of approximately 23.85 billion.