Roku Stock: Current Trends and Market Insights

Introduction

Roku Inc. has emerged as a significant player in the streaming media industry, captivating audiences with its innovative platform that seamlessly integrates content from various sources. As of 2023, the performance of Roku stock has become a crucial topic for investors, analysts, and technology enthusiasts alike. Understanding its market trends and financial standing is essential, particularly in light of the increasing competition in the streaming sector.

Recent Performance of Roku Stock

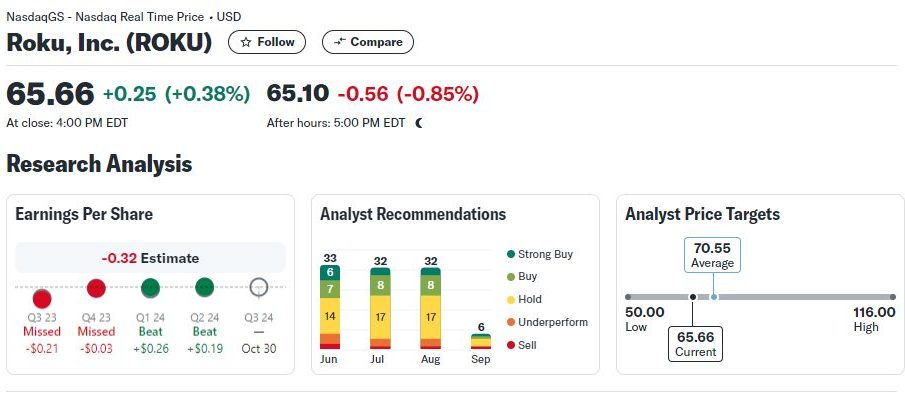

In the past few months, Roku’s stock price has witnessed fluctuations, reflective of broader market trends and company-specific developments. As of October 2023, Roku shares were trading around $65, which represents a notable recovery from its lows earlier in the year when it dipped below $50. This rebound can be attributed to several factors including better-than-expected earnings reports and strategic partnerships aimed at enhancing its content offerings.

In the second quarter of 2023, Roku reported a revenue increase of 25% year-over-year, driven by a rise in subscription services and advertising revenue. Analysts forecast continued growth for Roku, particularly with the rise of ad-supported streaming models, which could solidify its market share. Furthermore, Roku’s active accounts have reached new highs, now standing at over 70 million worldwide, indicating robust user engagement.

Market Challenges and Opportunities

Despite its positive growth indicators, Roku faces challenges from fierce competition in the streaming space, notably from tech giants like Amazon and Apple, which have robust ecosystems and can afford to invest heavily in content. Additionally, the overall economic climate, marked by inflationary pressures and rising interest rates, poses risks to consumer spending on discretionary items, including streaming services.

However, Roku’s strategic emphasis on expanding its advertising platform, Roku Channel, and partnerships with content providers may create opportunities for resilience. Analysts suggest that investing in original content and enhancing user experience through technology, such as improved algorithms for content recommendation, could provide a competitive edge.

Conclusion

The future of Roku stock remains a hot topic as it navigates through a rapidly evolving streaming landscape. Given its current growth trajectory and strategic initiatives, many investors maintain a cautiously optimistic outlook on Roku’s potential for long-term success. The company’s ability to adapt to market challenges and leverage its strengths will be critical in determining its stock performance in the coming months. Investors should stay informed on its quarterly earnings and market trends to make educated decisions moving forward.