Recent Developments in the Bank of Canada Interest Rate

Introduction

The Bank of Canada plays a pivotal role in shaping the economic landscape of the country through its monetary policy, particularly via the management of interest rates. Recently, the central bank’s decisions on interest rates have garnered significant attention due to rising inflation and shifting economic conditions. Understanding these changes is crucial for Canadians, especially as they affect borrowing costs, savings rates, and overall economic growth.

Latest Updates

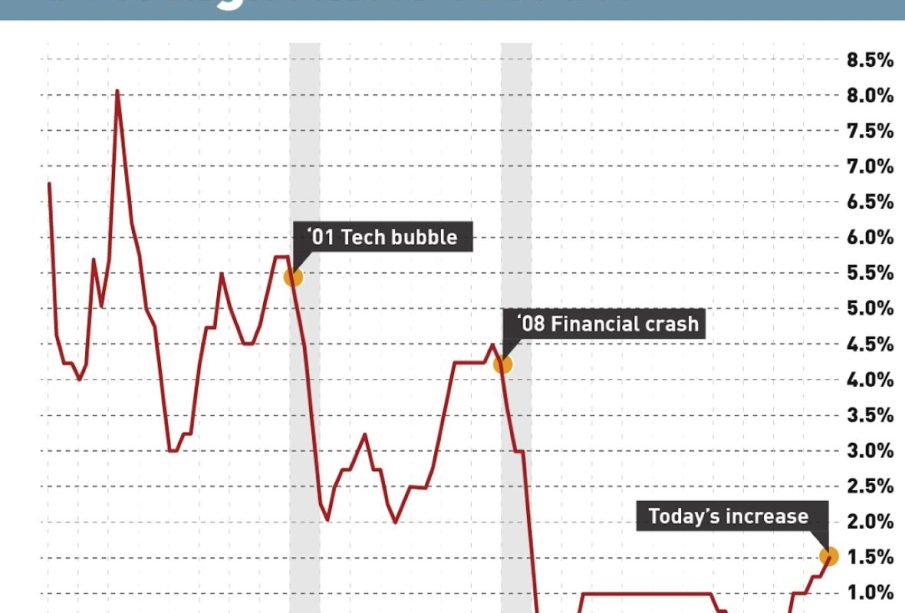

On October 25, 2023, the Bank of Canada announced a significant change in its benchmark interest rate, raising it from 5.00% to 5.25%. This decision came as inflation remained stubbornly high at 4.5%, exceeding the bank’s target of 2%. The increase intends to curb inflationary pressures and stabilize the economy.

Governor Tiff Macklem emphasized that while the economy shows resilience, the persistent inflation is a concern that necessitates a tighter monetary stance. Household spending, buoyed by a tight labor market, has contributed to inflation, prompting the bank to take action. Analysts predict that this rate hike may lead to higher costs for mortgages and loans, influencing consumer spending patterns.

Expert Opinions

Economists have varied opinions on the implications of the latest interest rate hike. Some argue that while the increase is necessary to battle inflation, it could also slow down economic growth. “Higher interest rates might discourage borrowing, which can hinder investment and consumer spending,” says David MacDonald, a senior economist at the Canadian Centre for Policy Alternatives.

Conversely, others believe the hike is a proactive measure to prevent inflation from spiraling further out of control. Olivia Chow, a financial analyst with Econometric Insights, stated, “It’s essential for the Bank of Canada to stay ahead of inflation. This move, although potentially painful in the short term, might help stabilize prices and promote longer-term economic health.”

Conclusion

As the Bank of Canada continues to navigate an uncertain economic environment, its interest rate decisions will be critical in influencing Canadians’ financial decisions. The recent rate increase serves as a reminder of the delicate balance the bank must maintain between curtailing inflation and supporting economic growth. Looking forward, many experts suggest that further adjustments may be necessary, depending on how the economy responds. Canadians are encouraged to stay informed on interest rate trends and adjust their financial plans accordingly in these changing times.