Recent Developments in PDD Stock: What Investors Need to Know

Introduction to PDD Stock

PDD Holdings, the parent company of Pinduoduo, has recently garnered attention in the stock market as it continues to evolve amidst changing economic conditions. Investors are keeping a close eye on PDD stock due to its performance, particularly in relation to e-commerce trends in China and the looming effects of global market dynamics.

Recent Market Trends

As of October 2023, PDD stock has experienced significant fluctuations. After showing a strong performance during the early months of 2023, the stock has faced volatility due to multiple factors, including economic challenges in China and shifts in consumer behavior. Analysts note that while there was a considerable surge in shares following Pinduoduo’s expansion into international markets, investor sentiment has been affected by regulatory changes and competition from other e-commerce platforms.

Financial Performance

In its most recent quarterly earnings report, PDD Holdings reported a remarkable increase in revenue, achieving an annual increase of over 30%. This performance is attributable to the company’s successful strategies that have captivated a growing customer base. However, despite the promising revenue growth, profit margins are being squeezed due to escalating operational costs and increased marketing spending aimed at both acquiring and retaining customers.

Key Events Impacting PDD Stock

Several key events have contributed to PDD stock’s performance. The recent launch of promotional campaigns aimed at driving sales has been a significant focus. Moreover, the company’s investment in technology and logistics has been acknowledged as a proactive measure to enhance user experience and supply chain efficiency, which could bode well for future stock performance.

Market Sentiment and Investor Outlook

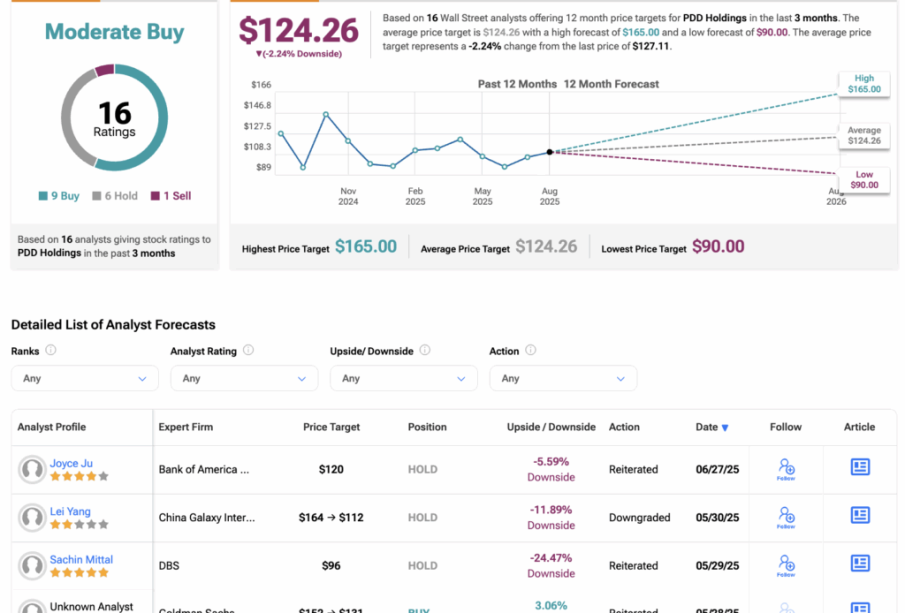

Investor sentiment regarding PDD stock remains mixed. Some analysts predict potential for future growth, citing PDD’s robust market strategies and expansion plans, while others caution against potential pitfalls, such as intensifying competition and changing regulatory landscapes. As PDD grows its footprint beyond China, foreign market dynamics play a critical role in shaping its operational success.

Conclusion: The Future of PDD Stock

In conclusion, PDD stock remains an important entity in the stock market, especially within the tech and e-commerce sectors. Investors should continue to monitor developments closely, as the company navigates through a rapidly changing landscape. With strategic investments and market expansion initiatives, PDD could prove to be a resilient choice for those looking to diversify their portfolios. Future earnings reports and market conditions will provide clearer insights on the sustainability of PDD’s current stock valuation as it adapts to the global market.