Pierre Poilievre’s Tax Cuts: An Overview of His Economic Strategy

Introduction

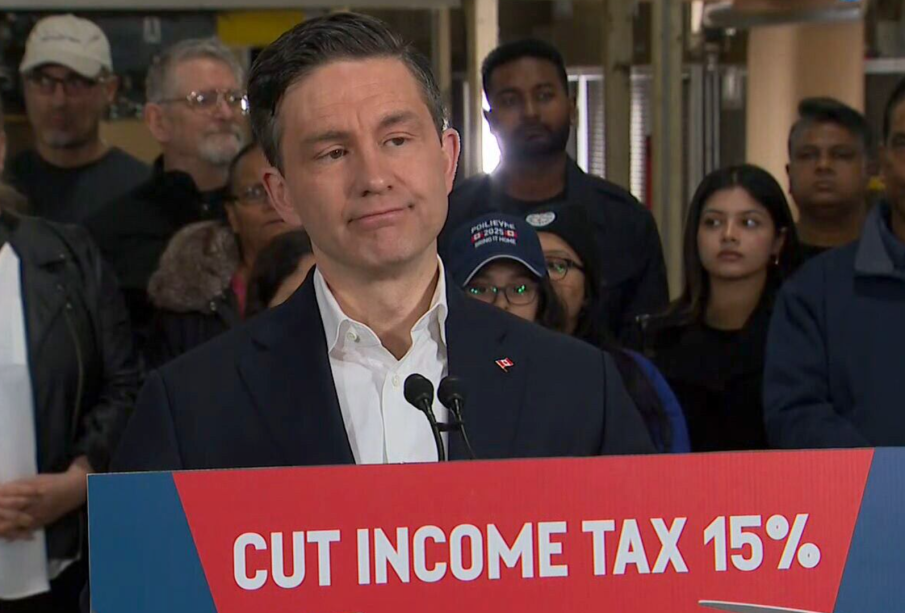

In the current political landscape, tax policy is a critical topic that directly impacts the financial well-being of Canadians. Pierre Poilievre, the leader of the Conservative Party of Canada, has made tax cuts a focal point of his economic strategy as he positions himself as a viable alternative to the current Liberal government. The proposal for tax cuts is not only significant for fiscal policies but also for how it could influence the upcoming federal elections.

Details of His Tax Cut Proposal

Pierre Poilievre’s tax plan emphasizes reducing the tax burden on middle-class and working Canadian families. In his public statements, he has proposed measures to cut the Goods and Services Tax (GST), eliminate carbon taxes, and reduce income taxes for individuals and businesses. Poilievre argues that these cuts would stimulate economic growth by encouraging consumer spending and investment.

Recent reports suggest that Poilievre plans to phase out the GST over a period of time, which he claims will leave families with more money to spend. This approach aligns with his broader economic philosophy which advocates for a smaller government and greater financial freedom for individuals.

Public Reception and Political Implications

The reaction to Poilievre’s tax cut proposals has been mixed. Supporters laud his plans as a necessary move to alleviate the high cost of living that many families face, especially in the wake of inflationary pressures brought on by the pandemic and global economic challenges. Critics, including members of the Liberal Party, argue that such tax cuts could lead to a significant decrease in public revenue, jeopardizing essential services like healthcare and education.

Polling data indicates that while some voters are keen on lower taxes, others express concern about potential trade-offs, particularly regarding social programs. This polarization suggests that Poilievre’s tax cuts could become a pivotal issue in the lead-up to the next federal election.

Conclusion

Pierre Poilievre’s push for tax cuts represents a vital component of his economic vision for Canada. As the political landscape evolves and elections draw near, Canadians will be watching closely to see how this proposal develops and what it could mean for the country’s fiscal future. Whether these proposed tax cuts garner enough support to lead to substantial policy changes remains to be seen, but they have certainly ignited a critical conversation about economic priorities and the role of government in the lives of everyday citizens.