Overview of Hive Stock Performance in 2023

Introduction to Hive Stock

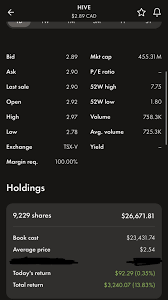

Hive Stock, listed on the TSX Venture Exchange, has become a focal point for investors interested in the cryptocurrency mining sector. As the cryptocurrency market continues to evolve, Hive Stock’s performance reflects not only the company’s operational success but also the broader trends and challenges associated with digital currencies. Understanding Hive’s market position, financial health, and industry developments is crucial for potential investors and those interested in the fintech landscape.

Recent Developments

In 2023, Hive Blockchain Technologies Ltd. has made significant strides in expanding its cryptocurrency mining operations. The company has reported a substantial growth in its mining capacity, leveraging renewable energy sources to enhance efficiency and decrease operational costs. As a result, Hive experienced a marked increase in its mining output, leading to enhanced revenue amidst fluctuating Bitcoin prices. In Q1 2023, Hive announced a 30% increase in Bitcoin production, highlighting the company’s commitment to maintaining a competitive edge in a rapidly changing market.

Market and Financial Performance

Over the past year, Hive’s stock has experienced notable volatility, mirroring the broader cryptocurrency market trends. In the first half of 2023, Hive’s stock price saw fluctuations, impacted by external factors such as regulatory changes and global economic conditions. According to financial analysts, Hive’s strategy of diversifying its crypto asset portfolio and investing in additional mining rigs, particularly in regions with low energy costs, has positioned it well against competitors.

As of the latest reporting, Hive’s market capitalization stood at approximately CAD 1 billion, and analysts predict that sustained growth could occur if Bitcoin and Ethereum prices stabilize and increase. The company’s pivot towards environmentally sustainable practices also caters to a growing segment of socially conscious investors.

Conclusion and Future Outlook

In conclusion, Hive Stock presents both opportunities and risks for investors navigating the volatile cryptocurrency landscape. Its strategic initiatives in expanding mining operations and sustainable practices suggest a promising trajectory. However, prospective investors should remain cautious and stay informed about the cryptocurrency market’s unpredictable nature and regulatory developments that could impact Hive’s operations. As Hive Blockchain Technologies continues to adapt to market conditions, its ability to maintain growth could significantly influence its stock performance in the coming years.