Oracle Stock Performance: An Analysis of Recent Trends

Introduction

Oracle Corporation, a global leader in cloud infrastructure and enterprise software, has recently gained notable attention in financial markets. With the rise of cloud computing and SaaS (Software as a Service), Oracle’s stock is a significant topic for investors and market analysts alike. Understanding the performance of Oracle stock is crucial for investors looking to capitalize on technology sector trends.

Recent Performance and Trends

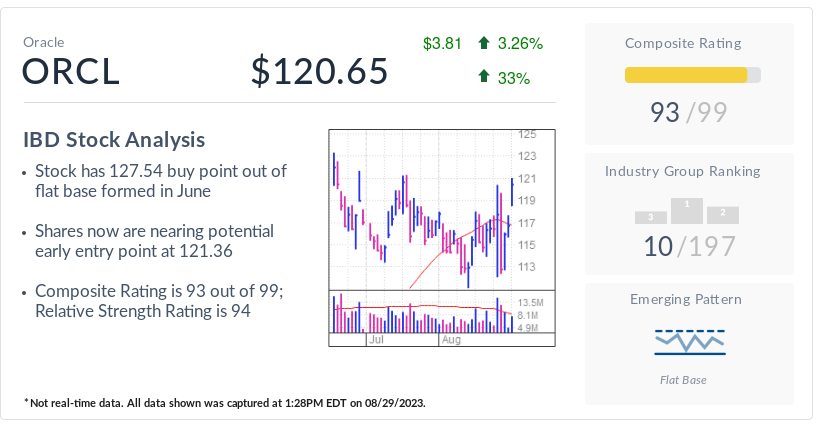

As of October 2023, Oracle’s stock has shown a robust rise, with an increase of approximately 25% over the past year. The company’s effective shift to cloud-based services has played a critical role in boosting investor confidence. In its latest earnings report released in September, Oracle reported revenue growth of 18% year-over-year, largely driven by a 40% increase in its cloud services revenue. This surge has positioned Oracle as a top contender against competitors like Microsoft and Amazon in the cloud space.

The positive earnings report led to a spike in share prices, which reached an all-time high of $110 in early October. Analysts have attributed this growth to strong demand for their cloud solutions and the integration of AI (Artificial Intelligence) technologies into their offerings. Furthermore, Oracle’s strategic acquisitions have expanded their portfolio, making them more competitive in the marketplace.

Market Sentiment and Analyst Opinions

Market sentiment around Oracle stock remains largely optimistic, with many analysts recommending it as a ‘buy.’ According to a report by Morgan Stanley, Oracle’s stock could potentially reach $120 by the end of 2024, assuming continued success in their cloud initiatives. The firm highlighted Oracle’s consistent investment in technology innovation and its ability to maintain a solid customer base as significant factors in its growth trajectory.

Conversely, some analysts caution that increasing competition and market volatility could pose risks. While Oracle’s growth is commendable, the tech sector remains subject to rapid changes and shifts in consumer preferences, which might impact future performance.

Conclusion

In summary, Oracle stock is demonstrating strong growth and resilience in a competitive landscape, remarkably aided by its focus on cloud computing and modern technological integration. Investors should continue to monitor Oracle’s performance and market strategies as the company navigates through an evolving digital landscape. The optimistic outlook from analysts indicates that, with sustained growth and innovation, Oracle could remain a key player in the tech industry for years to come.