Opendoor Stock’s Remarkable Journey: Leadership Transition and Strategic Shifts Drive Market Performance

Recent Market Performance and Leadership Changes

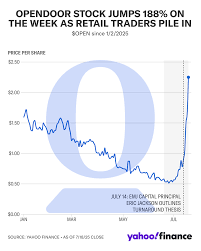

Opendoor Technologies’ stock has shown significant momentum, with an 11.58% increase on September 5, 2025, rising from $5.96 to $6.65, marking its sixth consecutive day of gains.

The company has undergone significant changes in leadership, with pressure from individual traders and social media influencers leading to management shifts. Former CEO Carrie Wheeler resigned in August, subsequently filing paperwork to sell 7 million Opendoor shares worth approximately $35 million.

Financial Performance and Market Position

The company’s financial performance has faced challenges, with revenue declining to $5.15 billion in 2024, representing a 25.81% decrease from the previous year’s $6.95 billion. Losses increased by 42.5% compared to 2023, reaching $392.00 million.

As a digital platform for residential real estate transactions in the United States, Opendoor buys and sells homes, offering various services including direct home sales to the company, MLS listings with cash offers, and a marketplace connecting home sellers with institutional or retail buyers.

Future Outlook and Market Analysis

The company is making strategic moves toward artificial intelligence integration, with interim CEO Shrisha Radhakrishna sharing the company’s AI vision, though some analysts express concern that current market enthusiasm might be masking underlying business challenges.

Market analysts maintain a cautious stance, citing macroeconomic challenges including rising interest rates and reduced consumer demand for housing. The company faces ongoing challenges with declining revenues and increased operational costs, leading to lower profit margins and significant losses in recent quarters.

Investment Perspective

Technical indicators show positive signals, with buy signals from both short and long-term Moving Averages, and the short-term average positioning above the long-term average suggests a positive forecast. However, analysts project a 30-day outlook suggesting potential decline, with an average price target of $5.6561, ranging between $5.8845 and $5.4277.