National Bank Stock: Analysis and Future Outlook

Introduction

National Bank of Canada is one of the prominent financial institutions in the country, serving millions of clients and playing a crucial role in the banking sector. As Canadian investors look toward the stock market for growth opportunities, National Bank stock has emerged as a significant point of interest. Understanding its performance, recent developments, and future outlook is essential for both seasoned and novice investors.

Recent Performance

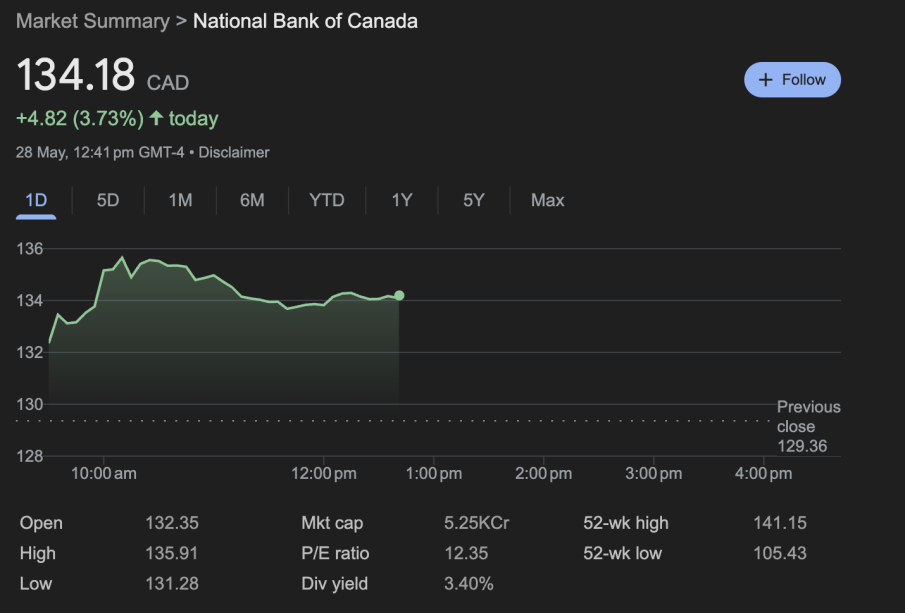

In recent months, National Bank stock has shown resilience amidst various economic fluctuations. As of late October 2023, the stock was trading at approximately CAD 95, reflecting a modest increase of 8% from the beginning of the year. Analysts attribute this growth to the bank’s robust financial performance bolstered by increased lending rates and a healthy demand for mortgages.

Factors Influencing Stock Value

Several factors have been pivotal in influencing the stock’s performance:

- Interest Rates: The Canadian economy has seen a rising interest rate environment, which directly benefits banks like National Bank through widened interest margins.

- Economic Stability: As Canada’s economy continues to recover post-pandemic, consumer confidence and spending have increased, positively impacting the bank’s loan growth.

- Regulatory Environment: Changes in government policies and banking regulations also play a crucial role in shaping investor sentiment and stock valuation.

Recent Developments

In September 2023, National Bank announced its latest quarterly results, which exceeded analysts’ expectations, revealing a net income of CAD 700 million. Additionally, the bank’s decision to increase its dividend payout reflects its confidence in sustainable growth, further attracting investor interest.

The Road Ahead

As we approach the end of the fiscal year, analysts remain cautiously optimistic about the future of National Bank stock. They anticipate that a combination of economic factors, including manageable inflation rates and consumer spending, will continue to provide a favorable environment for the bank.

Conclusion

In summary, National Bank stock remains a critical component of the Canadian financial landscape. With positive quarterly results, increasing dividends, and a healthy economic backdrop, the stock appears poised for steady growth. Investors should keep an eye on external economic factors and internal bank performance as they consider opportunities within this sector.